by Calculated Risk on 1/17/2023 08:33:00 PM

Tuesday, January 17, 2023

Wednesday: Retail Sales, PPI, Industrial Production, Homebuilder Confidence, Fed's Beige Book

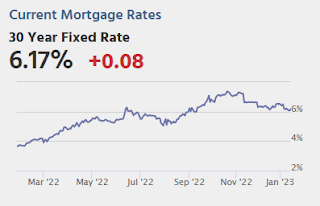

By the middle of December, bond yields made a convincing move down from decades-long highs and settled in a sideways range on CPI/Fed week. We re-entered that same sideways range after last week's CPI (3.42-3.62 in 10yr yields), and now wait for a slew of mid-tier reports to see if they're up to the task of informing a new range breakout. [30 year fixed 6.17%]Wednesday:

emphasis added

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, Retail sales for December is scheduled to be released. The consensus is for a 0.8% decrease in retail sales.

• Also 8:30 AM, The Producer Price Index for December from the BLS. The consensus is for a 0.1% decrease in PPI, and a 0.1% increase in core PPI.

• At 9:15 AM, The Fed will release Industrial Production and Capacity Utilization for December. The consensus is for a 0.1% decrease in Industrial Production, and for Capacity Utilization to decrease to 79.6%.

• At 10:00 AM, The January NAHB homebuilder survey. The consensus is for a reading of 31, unchanged from 31 in December. Any number below 50 indicates that more builders view sales conditions as poor than good.

• At 2:00 PM, the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.