by Calculated Risk on 11/26/2022 08:11:00 AM

Saturday, November 26, 2022

Schedule for Week of November 27, 2022

The key report this week is the November employment report on Friday.

Other key indicators include the 2nd estimate of Q3 GDP, the September Case-Shiller and FHFA house price indexes, October Personal Income & Outlays (and PCE), the November ISM manufacturing index, and November vehicle sales.

Fed Chair Powell speaks on the economic outlook, inflation and the labor market on Thursday.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for November. This is the last of the regional Fed manufacturing surveys for November.

9:00 AM ET: S&P/Case-Shiller House Price Index for September.

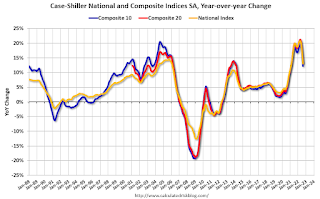

9:00 AM ET: S&P/Case-Shiller House Price Index for September.This graph shows graph shows the Year over year change in the seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the most recent report (the Composite 20 was started in January 2000).

The consensus is for a 14.4% year-over-year increase in the Composite 20 index for September.

9:00 AM: FHFA House Price Index for September. This was originally a GSE only repeat sales, however there is also an expanded index. The 2023 Conforming loan limits will also be announced.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for November. This report is for private payrolls only (no government). The consensus is for 200,000 jobs added, down from 239,000 in October.

8:30 AM: Gross Domestic Product (Second Estimate) and Corporate Profits (Preliminary), 3rd Quarter 2022. The consensus is that real GDP increased 2.7% annualized in Q3, up from the advance estimate of 2.6% in Q3.

9:45 AM: Chicago Purchasing Managers Index for November.

10:00 AM ET: Job Openings and Labor Turnover Survey for October from the BLS.

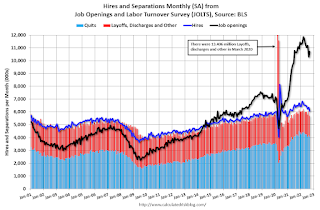

10:00 AM ET: Job Openings and Labor Turnover Survey for October from the BLS. This graph shows job openings (black line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings increased in September to 10.717 million from 10.280 million in August.

10:00 AM: Pending Home Sales Index for October. The consensus is for a 5.0% decrease in the index.

1:30 PM: Speech, Fed Chair Jerome Powell, Economic Outlook, Inflation, and the Labor Market, At the Brookings Institution, 1775 Massachusetts Avenue N.W., Washington, D.C.

2:00 PM: the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

10:30 AM: (likely) FDIC Quarterly Banking Profile, Third quarter.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 235 thousand initial claims, down from 240 thousand last week.

8:30 AM ET: Personal Income and Outlays, October 2022. The consensus is for a 0.4% increase in personal income, and for a 0.8% increase in personal spending. And for the Core PCE price index to increase 0.3%. PCE prices are expected to be up 6.2% YoY, and core PCE prices up 5.0% YoY.

10:00 AM: ISM Manufacturing Index for November. The consensus is for 50.0%, down from 50.2%.

10:00 AM: Construction Spending for October. The consensus is for 0.3% decrease in spending.

All day: Light vehicle sales for November.

All day: Light vehicle sales for November.The consensus is for 14.9 million SAAR in November, unchanged from the BEA estimate of 14.9 million SAAR in October (Seasonally Adjusted Annual Rate).

This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the current sales rate.

8:30 AM: Employment Report for November. The consensus is for 200,000 jobs added, and for the unemployment rate to be unchanged at 3.7%.

8:30 AM: Employment Report for November. The consensus is for 200,000 jobs added, and for the unemployment rate to be unchanged at 3.7%.There were 261,000 jobs added in October, and the unemployment rate was at 3.7%.

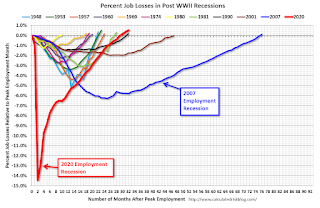

This graph shows the job losses from the start of the employment recession, in percentage terms.

The current employment recession was by far the worst recession since WWII in percentage terms. However, as of August, all of the jobs had returned and, as of October, were 804 thousand above pre-pandemic levels.