by Calculated Risk on 11/08/2022 03:31:00 PM

Tuesday, November 08, 2022

CPI Preview and Owners' equivalent rent

On Thursday, the BLS will release inflation data for October. The consensus is for a 0.7% increase in CPI, and a 0.5% increase in core CPI. The consensus is for CPI to be up 8.0% year-over-year and core CPI to be up 6.6% YoY.

Here is a preview from Goldman Sachs economists Manuel Abecasis and Spencer Hill:

We expect a below-consensus 0.44% increase in core CPI in October (vs. 0.5% consensus), which would lower the year-on-year rate to 6.46% (vs. 6.5% consensus). We expect moderate increases in both food and energy prices to raise headline CPI by 0.49% (vs. 0.6% consensus), which would lower the year-on-year rate to 7.8% (vs. 7.9% consensus).Recently we've seen used car prices down over 10% YoY, and framing lumber prices down 33% YoY. One of the keys will be rent, especially Owners' equivalent rent (OER). In Goldman's note, they echoed Fed Chair Powell's comment about rents have "some significant rate increases coming":

[W]e expect shelter inflation to run hot (rent +0.78%, OER + 0.75%)—even though alternative web-based measures of new tenant rent growth have slowed—because continuing tenant rent levels still have a long way to catch up to new tenant market rates.However, Rental housing economist Jay Parsons argues rental data will "cool faster than the Fed expects:

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here's the data to show real-life rent inflation will cool faster than the Fed suggested last week-- and not just for asking rents:

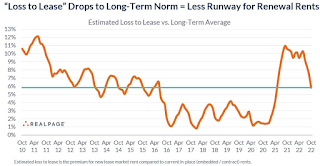

We’ve plunged back to long-term average in “loss to lease” – meaning the runway for renewal lease rents will significantly narrow going forward...

“Loss to lease” is the gap between today’s market asking rents and the average in-place (embedded) rent (aka “contract rent,” which is what the CPI attempts to measure). As a general rule of thumb: The larger the loss to lease, the larger the renewal increase...

Here is a dissertation from economist Adam Ozimek showing a significant lag in CPI measured rents: Sticky Rents and the CPI for Owner-Occupied Housing Rent inflation will be a key for the Fed.

CHRISTOPHER RUGABER. Thank you, Chris Rugaber at Associated Press. Just to go back to housing for a minute, you mentioned the impact that rate increases have had on housing, home sales are down 25 percent in the past year, and so forth, but none of this is really showing up in, as you know, in the government's inflation measures. And as we go forward, private real-time data is clearly showing these hits to housing. Are you going to need to put a greater weigh on that in order to ascertain things like whether there's over tightening going on or will you still focus as much on the more lagging government indicators?

CHAIR POWELL. So this is an interesting subject. So I start by saying I guess that the measure that's in the CPI and the PCE, it captures rents for all tenants, not just the new, not just new leases. And that makes sense actually because that, for that reason, that conceptually that is, that's sort of the right target for monetary policy. And the same thing is true for owners' equivalent rent which comes off of, it's a re-weighting of tenant rents. The private measures are of course good at picking up the, at the margin, the new leases and they tell you a couple things; one thing is, once you, I think right now, if you look at the pattern of that series of the new leases, it's very pro-cyclical, so rents went up much more than the CPI and PCE rents did. And now they're coming down faster. So but what you're, the implication is that there are still as people, as non-new leases rollover and expire, right? You still, they're still in the pipeline, there's still some significant rate increases coming. Okay? But at some point, once you get through that, the new leases are going to tell you, what they're telling you is there will come a point at which rent inflation will start to come down. But that point is well out from where we are now. So we're well-aware of that of course and we look at it. And we've, but I would say that in terms of the right way to think about inflation really is to look at the measure that we do look at, but considering that we also know that at some point you'll see rents coming down.

emphasis added