by Calculated Risk on 9/25/2022 11:58:00 AM

Sunday, September 25, 2022

Monthly Mortgage Payments Up Record Year-over-year

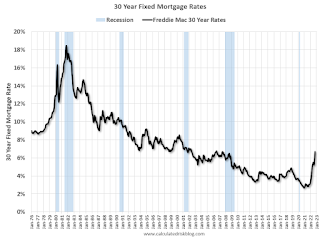

On Friday, the average 30-year mortgage rate hit 6.7% for zero points and top tier scenarios. This was the highest rate in 14 years and is close to the highest rate in over 20 years (above 6.76% will be the highest since early 2002).

Here is a graph showing the 30-year rate using Freddie Mac PMMS, and MND for last week.

This is a graph from Mortgage News Daily (MND) showing 30-year fixed rates from three sources (MND, MBA, Freddie Mac) over the last 5 years.

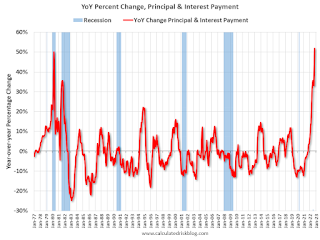

Yes, rates were much higher in the 1980 period, but it is the change in monthly payments that impacts housing. Monthly payments include principal, interest, taxes, insurance (PITI), and sometimes HOA fees (Homeowners Association). We could also include maintenance, utilities and other costs.

The following graph shows the year-over-year change in principal & interest (P&I) assuming a fixed loan amount since 1977. Currently P&I is up about 52% year-over-year for a fixed amount (this doesn’t take into account the change in house prices).

This is above the previous record increase of 50% in 1980. This assumed a fixed loan amount - if we add in the year-over-year increase in house prices, payments would be up around 65% YoY for the same house.

This is above the previous record increase of 50% in 1980. This assumed a fixed loan amount - if we add in the year-over-year increase in house prices, payments would be up around 65% YoY for the same house.

This is one of the reasons I've argued in my real estate newsletter Housing: Don't Compare the Current Housing Boom to the Bubble and Bust, Look instead at the 1978 to 1982 period for lessons.

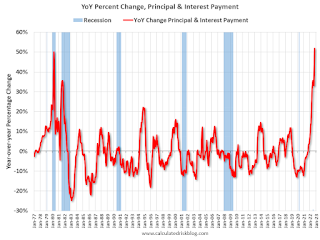

The following graph shows the year-over-year change in principal & interest (P&I) assuming a fixed loan amount since 1977. Currently P&I is up about 52% year-over-year for a fixed amount (this doesn’t take into account the change in house prices).

This is above the previous record increase of 50% in 1980. This assumed a fixed loan amount - if we add in the year-over-year increase in house prices, payments would be up around 65% YoY for the same house.

This is above the previous record increase of 50% in 1980. This assumed a fixed loan amount - if we add in the year-over-year increase in house prices, payments would be up around 65% YoY for the same house.This is one of the reasons I've argued in my real estate newsletter Housing: Don't Compare the Current Housing Boom to the Bubble and Bust, Look instead at the 1978 to 1982 period for lessons.