by Calculated Risk on 9/21/2022 08:59:00 AM

Wednesday, September 21, 2022

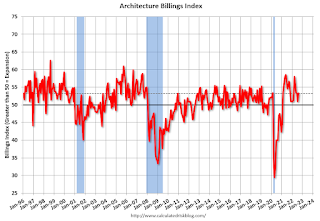

AIA: Architecture Billings Index shows "Demand for design services accelerates" in August

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: Demand for design services accelerates

Demand for design services from U.S. architecture firms grew at an accelerated pace in August, according to a new report today from The American Institute of Architects (AIA).

AIA’s Architecture Billings Index (ABI) score for August rose to 53.3 compared to 51.0 in July (any score above 50 indicates an increase in billings). During August, the score for new project inquiries rose to 57.9 from 56.1 the previous month, while the design contracts score softened slightly with a score of 52.3, down from 52.9 in July.

“While a strengthening billings score is encouraging, the flat scoring across regions and sectors is indicative of a nationwide deceleration over the next several months, said AIA Chief Economist, Kermit Baker, Hon. AIA, PhD. “A variety of economic storm clouds continue to gather, but since design activity continues to increase, we can expect at least another 9–12-month runway before building construction activity is negatively affected.”

...

• Regional averages: South (52.9); Midwest (51.4); West (50.2); Northeast (49.8)

• Sector index breakdown: multi-family residential (52.0); institutional (52.0); commercial/industrial (51.2); mixed practice (51.2)

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 53.3 in August, up from 51.0 in July. Anything above 50 indicates expansion in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

This index has been positive for 19 consecutive months. This index usually leads CRE investment by 9 to 12 months, so this index suggests a pickup in CRE investment into 2023.