by Calculated Risk on 9/08/2021 07:00:00 AM

Wednesday, September 08, 2021

MBA: Mortgage Applications Decrease in Latest Weekly Survey

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 1.9 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending September 3, 2021.

... The Refinance Index decreased 3 percent from the previous week and was 4 percent lower than the same week one year ago. The seasonally adjusted Purchase Index decreased 0.2 percent from one week earlier. The unadjusted Purchase Index decreased 3 percent compared with the previous week and was 18 percent lower than the same week one year ago.

“Mortgage application volume fell last week to its lowest level since mid-July, as mortgage rates have stayed just above 3% for several weeks. Refinance volume has been moderating, while purchase volume continues to be lower than expected given the lack of homes on the market,” said Mike Fratantoni, MBA's Senior Vice President and Chief Economist. “Economic data has sent mixed signals, with slower job growth but a further drop in the unemployment rate in August. We expect that further improvements will lead to a tapering of Fed MBS purchases by the end of the year, which should put some upward pressure on mortgage rates.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($548,250 or less) remained unchanged at 3.03 percent, with points decreasing to 0.33 from 0.34 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

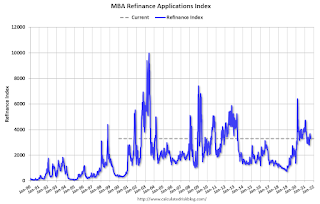

Click on graph for larger image.The first graph shows the refinance index since 1990.

With low rates, the index remains elevated.

The second graph shows the MBA mortgage purchase index

According to the MBA, purchase activity is down 18% year-over-year unadjusted.

According to the MBA, purchase activity is down 18% year-over-year unadjusted.Note: The year ago comparisons for the unadjusted purchase index are now difficult since purchase activity picked up in late May 2020.

Note: Red is a four-week average (blue is weekly).