by Calculated Risk on 4/07/2021 07:00:00 AM

Wednesday, April 07, 2021

MBA: Mortgage Applications Decrease in Latest Weekly Survey

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 5.1 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending April 2, 2021.

... The Refinance Index decreased 5 percent from the previous week and was 20 percent lower than the same week one year ago. The seasonally adjusted Purchase Index decreased 5 percent from one week earlier. The unadjusted Purchase Index decreased 4 percent compared with the previous week and was 51 percent higher than the same week one year ago.

“Mortgage rates resumed their upward move last week, with the 30-year fixed rate at 3.36 percent. The return of rates to the highest level since last June contributed to a slowdown in applications for both purchases and refinances. The rapidly recovering economy and improving job market is generating sizeable home buying demand, but activity in recent weeks is constrained by quicker home-price growth and extremely low inventory,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “Refinance applications declined for the fifth straight week, but there was a gain in VA loan activity. Overall, refinance demand has decreased, with volume over the past 10 weeks down by more than 30 percent.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($548,250 or less) increased to 3.36 percent from 3.33 percent, with points increasing to 0.43 from 0.39 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

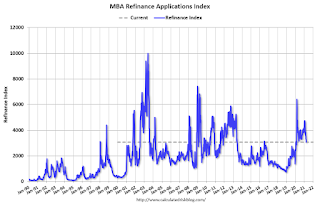

Click on graph for larger image.The first graph shows the refinance index since 1990.

With low rates, the index remains elevated, but falling as rates rise.

The second graph shows the MBA mortgage purchase index

According to the MBA, purchase activity is up 51% year-over-year unadjusted.

According to the MBA, purchase activity is up 51% year-over-year unadjusted.Note: Until the 2nd half of May, the MBA index will be up sharply year-over-year since purchase activity collapsed in late March 2020 in the early weeks of the pandemic.

Note: Red is a four-week average (blue is weekly).