by Calculated Risk on 3/22/2021 04:00:00 PM

Monday, March 22, 2021

MBA Survey: "Share of Mortgage Loans in Forbearance Decreases to 5.05%"

Note: This is as of March 14th.

From the MBA: Share of Mortgage Loans in Forbearance Decreases to 5.05%

The Mortgage Bankers Association’s (MBA) latest Forbearance and Call Volume Survey revealed that the total number of loans now in forbearance decreased by 9 basis points from 5.14% of servicers’ portfolio volume in the prior week to 5.05% as of March 14, 2021. According to MBA’s estimate, 2.5 million homeowners are in forbearance plans.

...

“New forbearance requests decreased to their lowest level since last March. Combined with a steady pace of exits, this drop in new requests resulted in a larger decline in the share of loans in forbearance across all investor categories,” said Mike Fratantoni, MBA’s Senior Vice President and Chief Economist. “More than 11 percent of borrowers in forbearance have now exceeded the 12-month mark. We anticipate that servicers will be busy over the next month, with many homeowners opting for the extension for up to 18 months recently made available for federally-backed loans.”

Fratantoni added, “The pace of economic activity is picking up as the vaccine rollout continues. We expect that a stronger job market will help many successfully exit forbearance in the months ahead.”

emphasis added

Click on graph for larger image.

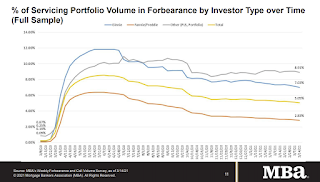

Click on graph for larger image.This graph shows the percent of portfolio in forbearance by investor type over time. Most of the increase was in late March and early April, and has trended down since then.

The MBA notes: "Total weekly forbearance requests as a percent of servicing portfolio volume (#) decreased relative to the prior week: from 0.07% to 0.05%, the lowest level since the week ending March 15, 2020."