by Calculated Risk on 3/08/2021 01:44:00 PM

Monday, March 08, 2021

Black Knight Mortgage Monitor for January

Black Knight released their Mortgage Monitor report for January today. According to Black Knight, 5.85% of mortgages were delinquent in January, down from 6.08% of mortgages in December, and up from 3.22% in January 2020. Black Knight also reported that 0.32% of mortgages were in the foreclosure process, down from 0.46% a year ago.

This gives a total of 6.17% delinquent or in foreclosure.

Press Release: Black Knight’s January 2021 Mortgage Monitor; Lock Activity Suggests Q1 2021 Refi Originations to Remain Near Record Highs as Rate Increases Cloud Q2 Outlook; Servicer Retention Hits New Low

Today, the Data & Analytics division of Black Knight, Inc. released its latest Mortgage Monitor Report, based upon the company’s industry-leading mortgage, real estate and public records datasets. This month’s report looks back on 2020 origination volumes as well as at rate lock data from Black Knight’s Secondary Marketing Technologies division to get a sense of how the market is faring as rates begin to rise. According to Black Knight Data & Analytics President Ben Graboske, despite interest rates recently spiking to more than 3.2% according to the daily tracking data of the company’s Optimal Blue Mortgage Market Index, Q1 2021 refinance lending volumes are poised to remain near Q4 2020’s record-breaking high.

“Roughly 2.8 million homeowners refinanced their mortgages in the last quarter of 2020, which saw a record-breaking $869 billion in refinance lending,” said Graboske. “Assuming a 45-day lock-to-close timeline, daily rate lock data from Black Knight through mid-February suggests refi activity could remain steady in Q1 2021. Of course, that’s before a recent spike in 30-year rates is expected to begin impacting closed loan volumes in late Q1 or early Q2. Still, by the end of March, another 2.8 million homeowners will have taken advantage of near-record-low rates to refinance their mortgages. It’s important to remember that this would be coupled with a 25% reduction from Q4 2020 in purchase loans as well, resulting in an overall 10% quarterly decline.

“With rates on the rise, refinance incentive has been significantly curtailed. Just under 13 million high-quality refinance candidates remain in the market – a nearly 30% drop in just the past three weeks. Added to that, retention of what is now a dwindling number of refinancing borrowers remains at record lows, with just 18% being retained by their servicers. Approximately 2.3 million borrowers were not retained in Q4 2020 alone. The current rate volatility serves to underscore the critical nature of both accurate and strategic pricing and advanced retention analytics to help identify borrowers who still have incentive and are out there transacting in the market.”

emphasis added

Click on graph for larger image.

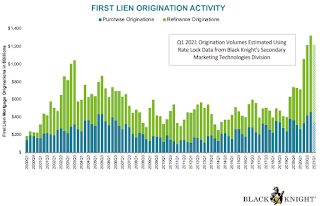

Click on graph for larger image.Here is a graph from the Mortgage Monitor that shows First Lien Origination Activity by quarter.

From Black Knight:

• All in, a record-breaking $4.3T was originated in 2020, with $2.8T in refis – also an all-time high – and $1.5T in purchase loans, the largest annual volume since 2005

• Q4 2020 set an all-time high for a single quarter across the board, with $346B in purchase lending, $869B in refinance lending and $1,322B in total lending

• By the end of March, an expected 2.8M homeowners will have taken advantage of near-record-low rates to refinance their mortgages

• It’s important to note that the same data suggests a 25% reduction from Q4 2020 in purchase loans, resulting in an overall 10% quarterly decline.

• Despite quarter-over-quarter decline, that would still put Q1 2021 purchase originations some 31% above 2020 levels

And on delinquencies from Black Knight:

And on delinquencies from Black Knight: • Early-stage delinquencies continue to stay below pre-pandemic levels, with the number of borrowers with a single missed payment down 24% and 60-day delinquencies down 6%There is much more in the mortgage monitor.

• However, despite some slight improvement in January, serious delinquencies (90+ days) remain 5X their pre-pandemic levels