by Calculated Risk on 12/21/2020 04:00:00 PM

Monday, December 21, 2020

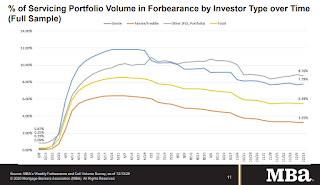

MBA Survey: "Share of Mortgage Loans in Forbearance Increases to 5.49%"

Note: This is as of December 13th.

From the MBA: Share of Mortgage Loans in Forbearance Increases to 5.49%

The Mortgage Bankers Association’s (MBA) latest Forbearance and Call Volume Survey revealed that the total number of loans now in forbearance increased slightly from 5.48% of servicers’ portfolio volume in the prior week to 5.49% as of December 13, 2020. According to MBA’s estimate, 2.7 million homeowners are in forbearance plans.

...

The share of loans in forbearance has stayed fairly level since early November, often with small decreases in the GSE loan share and increases for Ginnie Mae loans. That was the case last week. Additionally, forbearance requests from Ginnie Mae borrowers reached the highest level since the week ending June 14,” said Mike Fratantoni, MBA’s Senior Vice President and Chief Economist. “Additional restrictions on businesses and rising COVID-19 cases are causing a renewed increase in layoffs and other signs of slowing economic activity. These troubling trends will likely result in more homeowners seeking relief.”

...

By stage, 18.78% of total loans in forbearance are in the initial forbearance plan stage, while 78.54% are in a forbearance extension. The remaining 2.69% are forbearance re-entries.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of portfolio in forbearance by investor type over time. Most of the increase was in late March and early April, and has generally been trending down.

The MBA notes: "Weekly forbearance requests as a percent of servicing portfolio volume (#) remained flat from the previous week at 0.12 percent."