by Calculated Risk on 10/26/2020 04:00:00 PM

Monday, October 26, 2020

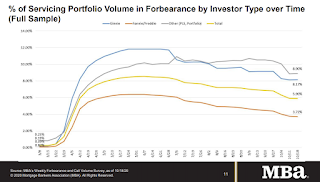

MBA Survey: "Share of Mortgage Loans in Forbearance Decreases Slightly to 5.90%"

Note: This is as of October 18th.

From the MBA: Share of Mortgage Loans in Forbearance Decreases Slightly to 5.90%

The Mortgage Bankers Association’s (MBA) latest Forbearance and Call Volume Survey revealed that the total number of loans now in forbearance decreased by 2 basis points from 5.92% of servicers’ portfolio volume in the prior week to 5.90% as of October 18, 2020. According to MBA’s estimate, 3.0 million homeowners are in forbearance plans.

...

“The share of loans in forbearance declined only slightly in the prior week, after two weeks of a flurry of borrowers exiting as they reached the six-month mark,” said Mike Fratantoni, MBA’s Senior Vice President and Chief Economist. “There continues to be a steady improvement for Fannie Mae and Freddie Mac loans, but the forbearance share for Ginnie Mae, portfolio, and PLS loans all increased. This is further evidence of the unevenness in the current economic recovery. The housing market is booming, as shown by the extremely strong pace of home sales last week. However, many homeowners continue to struggle, as the pace of the job market’s improvement has waned.”

...

By stage, 25.02% of total loans in forbearance are in the initial forbearance plan stage, while 73.14% are in a forbearance extension. The remaining 1.84% are forbearance re-entries.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of portfolio in forbearance by investor type over time. Most of the increase was in late March and early April, and has been trending down for the last few months.

The MBA notes: "Total weekly forbearance requests as a percent of servicing portfolio volume (#) increased relative to the prior week: from 0.10% to 0.11%."

There hasn't been a pickup in forbearance activity related to the end of the extra unemployment benefits.