by Calculated Risk on 4/17/2019 10:26:00 AM

Wednesday, April 17, 2019

AIA: "Architecture Billings Index backslides in March"

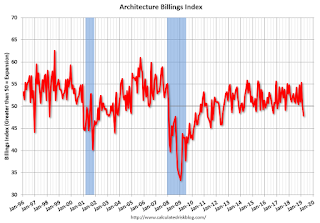

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: Architecture Billings Index backslides in March

Following consistently increasing demand for design services for over two years, the Architecture Billings Index (ABI) dipped into negative territory in March, according to a new report today from The American Institute of Architects (AIA).

The ABI score for March was 47.8, down from 50.3 in February. Indicators of work in the pipeline, including inquiries into new projects and the value of new design contracts remained positive.

“Though billings haven’t contracted in a while, it is important to note that it does follow on the heels of a particularly tough late winter period for much of the country,” said AIA Chief Economist Kermit Baker, PhD, Hon. AIA. “Many indicators of future work at firms still remain positive, although the pace of growth of design contracts has slowed in recent months.“

...

• Regional averages: South (54.2), Midwest (48.7), West (47.2), Northeast (43.5)

• Sector index breakdown: mixed practice (53.1), commercial/industrial (47.0), institutional (48.9), multi-family residential (47.7)

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 47.8 in March, down from 50.3 in February. Anything below 50 indicates contraction in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This index has been positive for 11 of the previous 12 months, suggesting a further increase in CRE investment in 2019.