by Calculated Risk on 10/16/2017 02:49:00 PM

Monday, October 16, 2017

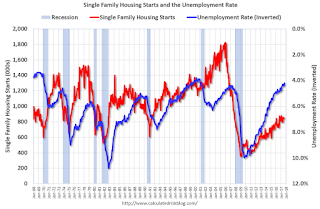

Housing Starts and the Unemployment Rate

By request, here is an update to a graph I haven't posted in several years ...

The graph below shows single family housing starts (red) and the unemployment rate (blue, inverted) through September 2017. Note: Of course there are many other factors impacting the unemployment rate, but housing is a key sector.

Usually when single family housing starts are increasing, then the unemployment rate is falling (with a lag).

You can see both the correlation and the lag. Housing starts fall (or increase) first, followed by the unemployment rate. The lag is usually about 12 to 18 months, with peak correlation at a lag of 16 months for single unit starts. The 2001 recession was a business investment led recession, and the pattern didn't hold.

Here is what I wrote when I first posted this graph in 2009. I wrote:

[T]here is still far too much existing home inventory, a sharp bounce back in housing starts is unlikely, so I think ... a rapid decline in unemployment is also unlikely.That is exactly what happened.

Usually near the end of a recession, residential investment1 (RI) picks up as the Fed lowers interest rates. This leads to job creation and also household formation - and that leads to even more demand for housing units - and more jobs, and more households - a virtuous cycle that usually helps the economy recover.

However, following the 2007 recession, with the huge overhang of existing housing units, this key sector didn't participate for a few years.

Currently I expect single family housing starts to continue to increase (still historically low), and for the unemployment rate to fall further.

1 RI is mostly new home sales and home improvement.