by Calculated Risk on 7/05/2017 12:54:00 PM

Wednesday, July 05, 2017

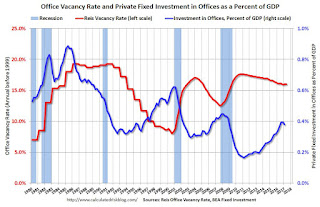

Office Vacancy Rate and Office Investment

Last week Reis reported the office vacancy rate was unchanged at 16.0% in Q2, from 16.0% in Q1.

A key question is whether office investment will increase further (as a percent of GDP). The following graph shows the office vacancy rate and office investment as a percent of GDP. Note: Office investment also includes improvements.

Here are some comments from Reis Economist Barbara Byrne Denham on Q2:

Continuing its lackluster pace, the Office market recorded the lowest quarterly net absorption in three years as the vacancy rate remained flat at 16.0%. One year ago, the vacancy rate was 16.1%. In the last expansion, the U.S. vacancy rate had fallen from a high of 17.0% in 2003 to a low of 12.5% in 2007. In the current expansion that is now seven quarters longer than the previous expansion, the vacancy rate has fallen from a high of 17.6% to only 16.0% as tenants have leased far fewer square feet per added employee than in past cycles.

...

Overall office employment growth for U.S. metro areas in 2017 has grown at a slightly slower but still healthy rate of 2.0%. Thus, we expect occupancy growth to remain positive in 2017. We expect stronger construction in 2017 than in 2016 which means that the vacancy rate could continue to stay flat as occupancy grows at or near the same pace as new completions just as it has over the last two years. This has kept rent growth low and should continue to do so this year and next.

Click on graph for larger image.

Click on graph for larger image.This graph shows the office vacancy rate starting in 1980 (prior to 1999 the data is annual). Back in the early '80s, there was overbuilding in the office sector even as the vacancy rate was rising. This was due to the very loose lending that led to the S&L crisis.

In the '90s, office investment picked up as the vacancy rate fell. Following the bursting of the stock bubble, the vacancy rate increased sharply and office investment declined.

During the housing bubble, office investment started to increase even before the vacancy rate had fallen below 14%. This was due to loose lending - again. Investment essentially stopped following the financial crisis.

Office investment has been increasing, and is now above the levels of previous slow periods. However the vacancy rate is still very high, suggesting office investment will not increase significantly going forward.

Office vacancy data courtesy of Reis.