by Calculated Risk on 6/16/2017 09:16:00 AM

Friday, June 16, 2017

Housing Starts decreased to 1.092 Million Annual Rate in May

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in May were at a seasonally adjusted annual rate of 1,092,000. This is 5.5 percent below the revised April estimate of 1,156,000 and is 2.4 percent below the May 2016 rate of 1,119,000. Single-family housing starts in May were at a rate of 794,000; this is 3.9 percent below the revised April figure of 826,000. The May rate for units in buildings with five units or more was 284,000.

Building Permits:

Privately-owned housing units authorized by building permits in May were at a seasonally adjusted annual rate of 1,168,000. This is 4.9 percent below the revised April rate of 1,228,000 and is 0.8 percent below the May 2016 rate of 1,178,000. Single-family authorizations in May were at a rate of 779,000; this is 1.9 percent below the revised April figure of 794,000. Authorizations of units in buildings with five units or more were at a rate of 358,000 in May.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (red, 2+ units) decreased in May compared to April. Multi-family starts are down 23% year-over-year.

Multi-family is volatile and has been down significantly over the last few months.

Single-family starts (blue) decreased in May, and are up 8.5% year-over-year.

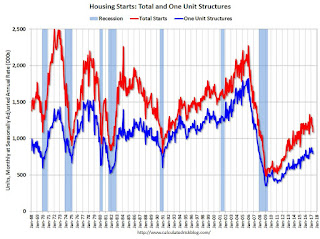

The second graph shows total and single unit starts since 1968.

The second graph shows total and single unit starts since 1968. The second graph shows the huge collapse following the housing bubble, and then - after moving sideways for a couple of years - housing is now recovering (but still historically low),

Total housing starts in May were well below expectations, and March and April were revised down. Most of the recent weakness has been due to multi-family. This is a weak report. I'll have more later ...