by Calculated Risk on 2/28/2017 03:48:00 PM

Tuesday, February 28, 2017

FDIC: Fewer Problem banks, Residential REO Declined in Q4

The FDIC released the Quarterly Banking Profile for Q4 today:

Commercial banks and savings institutions insured by the Federal Deposit Insurance Corporation (FDIC) reported aggregate net income of $43.7 billion in the fourth quarter of 2016, up $3.1 billion (7.7 percent) from a year earlier. The increase in earnings was mainly attributable to an $8.4 billion (7.6 percent) increase in net interest income. Financial results for the fourth quarter of 2016 are included in the FDIC's latest Quarterly Banking Profile released today.

Of the 5,913 insured institutions reporting fourth quarter financial results, 59 percent reported year-over-year growth in quarterly earnings. The proportion of banks that were unprofitable in the fourth quarter fell to 8.1 percent from 9.6 percent a year earlier.

...

Deposit Insurance Fund’s Reserve Ratio Rises to 1.20 Percent: The DIF increased $2.5 billion during the fourth quarter to $83.2 billion at the end of December, largely driven by assessment income. The DIF reserve ratio rose from 1.18 percent to 1.20 percent during the quarter. Estimated insured deposits increased 1.4 percent in the fourth quarter. For all of 2016, estimated insured deposits increased 6 percent.

emphasis added

Click on graph for larger image.

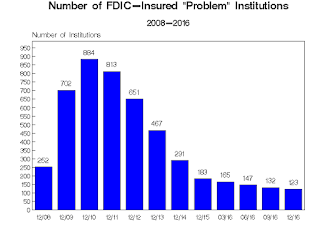

Click on graph for larger image.The FDIC reported the number of problem banks declined:

“Problem Bank List” Shows Further Improvement: The number of banks on the FDIC’s Problem Bank List fell from 132 to 123 during the fourth quarter. This is the smallest number of problem banks in more than seven years and is down significantly from the peak of 888 in the first quarter of 2011. Total assets of problem banks rose slightly from $24.9 billion to $27.6 billion during the fourth quarter.

The dollar value of 1-4 family residential Real Estate Owned (REOs, foreclosure houses) declined from $3.98 billion in Q3 2016 to $3.90 billion in Q4. This is the lowest level of REOs since Q1 2007.

The dollar value of 1-4 family residential Real Estate Owned (REOs, foreclosure houses) declined from $3.98 billion in Q3 2016 to $3.90 billion in Q4. This is the lowest level of REOs since Q1 2007.This graph shows the nominal dollar value of Residential REO for FDIC insured institutions. Note: The FDIC reports the dollar value and not the total number of REOs.

Since REOs are reported in dollars, and house prices have increased, it is unlikely FDIC institution REOs will get back to the $2.0 to $2.5 billion range back that happened in 2003 to 2005. FDIC REOs will probably bottom closer to $3 billion.