by Calculated Risk on 8/09/2016 11:00:00 AM

Tuesday, August 09, 2016

NY Fed: Household Debt Increased Slightly in Q2 2016, Delinquency Rates Declined

The Q2 report was released today: Household Debt and Credit Report.

From the NY Fed: Household Debt Balances Increase Slightly, Boosted By Growth In Auto Loan And Credit Card Balances

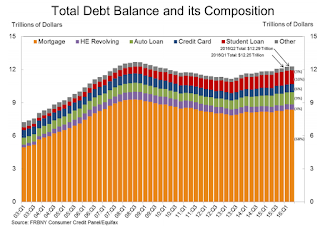

The Federal Reserve Bank of New York’s Center for Microeconomic Data today issued its Quarterly Report on Household Debt and Credit, which reported that household debt increased by $35 billion (a 0.3 percent increase) to $12.29 trillion during the second quarter of 2016. This moderate growth was driven by increases in auto loan and credit card debt, which increased by $32 billion and $17 billion respectively. Mortgage debt declined by $7 billion in the second quarter, after a $120 billion increase in the first quarter, and student loan balances were roughly flat. Meanwhile, this quarter saw improvements in overall delinquency rates and another historical low (over the 18 years of the data sample) in new foreclosures. ...

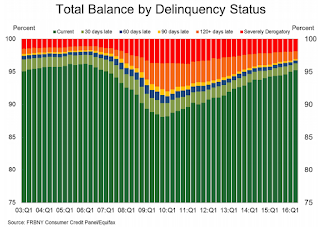

Overall delinquency rates improved, continuing the trend in place since 2010. In the second quarter, 4.8 percent of outstanding debt was in some stage of delinquency down from 5 percent previous quarter, and 5.6 percent in the second quarter of 2015. There were 82,000 consumers with new foreclosure notations on their credit reports – another low in the 18-year history of this data set.

...

"Today's report highlights a positive ongoing trend in household debt," said Donghoon Lee, Research Officer at the New York Fed. "Delinquency rates continue to improve, even as credit has become more widely available."

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here are two graphs from the report:

The first graph shows aggregate consumer debt increased in Q2. Household debt peaked in 2008, and bottomed in Q2 2013.

Mortgage debt decreased in Q2, from the NY Fed:

Mortgage balances, the largest component of household debt, were essentially flat in the second quarter of 2016. Mortgage balances shown on consumer credit reports on June 30 stood at $8.36 trillion, a $7 billion drop from the first quarter of 2016. Balances on home equity lines of credit (HELOC) also dropped by $7 billion, to $478 billion. Non-housing debt balances rose in the second quarter; with increases of $32 billion and $17 billion in auto loans and credit cards, respectively, and a slight decline in student loan balances (-$2 billion).

The second graph shows the percent of debt in delinquency. The percent of delinquent debt is declining, although there is still a larger than normal percent of debt 90+ days delinquent (Yellow, orange and red).

The second graph shows the percent of debt in delinquency. The percent of delinquent debt is declining, although there is still a larger than normal percent of debt 90+ days delinquent (Yellow, orange and red). The overall delinquency rate decreased in Q2 to 4.8%. From the NY Fed:

Overall delinquency rates improved again in 2016Q2. As of June 30, 4.8% of outstanding debt was in some stage of delinquency. Of the $589 billion of debt that is delinquent, $407 billion is seriously delinquent (at least 90 days late or “severely derogatory”).There are a number of credit graphs at the NY Fed site.