by Calculated Risk on 8/16/2016 10:36:00 AM

Tuesday, August 16, 2016

Early Look at 2017 Cost-Of-Living Adjustments and Maximum Contribution Base

The BLS reported this morning:

The Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) increased 0.4 percent over the last 12 months to an index level of 234.789 (1982-84=100).CPI-W is the index that is used to calculate the Cost-Of-Living Adjustments (COLA). The calculation dates have changed over time (see Cost-of-Living Adjustments), but the current calculation uses the average CPI-W for the three months in Q3 (July, August, September) and compares to the average for the highest previous average of Q3 months. Note: this is not the headline CPI-U, and is not seasonally adjusted (NSA).

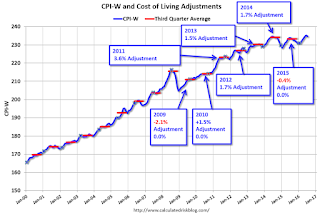

• In 2014, the Q3 average of CPI-W was 234.242. In the previous year, 2013, the average in Q3 of CPI-W was 230.327. That gave an increase of 1.7% for COLA for 2015.

• In 2015, the Q3 average of CPI-W was 233.278. That was a decline of 0.4% from 2014, however, by law, the adjustment is never negative so the benefits remained the same this year (in 2016).

Since the previous highest Q3 average was in 2014 (not 2015), at 234.242, we have to compare Q3 this year to two years ago.

Click on graph for larger image.

Click on graph for larger image.This graph shows CPI-W since January 2000. The red lines are the Q3 average of CPI-W for each year.

Note: The year labeled for the calculation, and the adjustment is effective for December of that year (received by beneficiaries in January of the following year).

CPI-W was up 0.4% year-over-year in July, and although this is very early - we need the data for July, August and September - my current guess is COLA will be slightly positive this year - but COLA could be zero again.

Contribution and Benefit Base

The law prohibits an increase in the contribution and benefit base if COLA is not greater than zero, so there was no change in the contribution and benefit base for 2016. However if the there is even a small increase in COLA (it will be close this year), the contribution base will be adjusted using the National Average Wage Index (and catch up for last year).

From Social Security: Cost-of-Living Adjustment Must Be Greater Than Zero

... ... any amount that is directly dependent for its value on the COLA would not increase. For example, the maximum Supplemental Security Income (SSI) payment amounts would not increase if there were no COLA.The contribution base will be adjusted using the National Average Wage Index. This is based on a one year lag. The National Average Wage Index is not available for 2015 yet, but wages probably increased again in 2015. If wages increased the same as last year, then the contribution base next year will increase to around $127,000 from the current $118,500.

... if there were no COLA, section 230(a) of the Social Security Act prohibits an increase in the contribution and benefit base (Social Security's maximum taxable earnings), which normally increases with increases in the national average wage index. Similarly, the retirement test exempt amounts would not increase ...

Remember - this is an early look. What matters is average CPI-W for all three months in Q3 (July, August and September).