by Calculated Risk on 6/06/2016 09:44:00 AM

Monday, June 06, 2016

Black Knight: First Time Foreclosure Starts Lowest on Record

Black Knight Financial Services (BKFS) released their Mortgage Monitor report for April today. According to BKFS, 4.24% of mortgages were delinquent in April, down from 4.72% in April 2015. BKFS also reported that 1.17% of mortgages were in the foreclosure process, down from 1.63% a year ago.

This gives a total of 5.41% delinquent or in foreclosure.

Press Release: Black Knight’s April Mortgage Monitor: Cash Transactions Account for Over 60 Percent of Low-Priced Home Sales

Today, the Data and Analytics division of Black Knight Financial Services, Inc. released its latest Mortgage Monitor Report, based on data as of the end of April 2016. This month, Black Knight looked at the cash share of residential real estate transactions by core-based statistical areas (CBSAs), breaking each CBSA into five equal price tiers. While the data showed that overall cash sales are slowing, they still account for the bulk of transactions on homes in the lowest 20 percent of property values. As Black Knight Data & Analytics Senior Vice President Ben Graboske explained, there is significant disparity between high- and low-end markets nationwide in this regard.

“As the inventory of distressed properties has dried up nationwide, the overall share of cash sales has been on the decline as well,” said Graboske. “From a peak of 45 percent of all real estate transactions back in Q1 2011, cash sales accounted for just 35 percent of home purchases in the first quarter of 2016. What’s striking though, is the disparity between the high and low ends of the market. At the national level, cash sales made up approximately 30 percent of transactions on properties in the top 20 percent by value of their respective markets. For those in the lowest 20 percent of property values, over 60 percent of sales were cash transactions. While down significantly from its peak of 75 percent of all transactions at the bottom of the housing market, this is still quite high for cash sales, historically. The prevalence of cash sales at the low end of the market can likely be chalked up to two primary factors. First, negative equity is still higher than average among this segment of the market, resulting in increased distressed discounts for buyers. Second, lower-priced homes simply require less capital to purchase outright, making cash sales possible for more people.”

emphasis added

Click on graph for larger image.

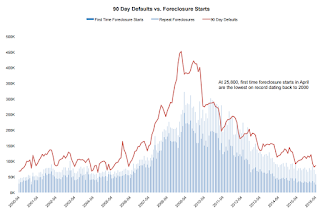

Click on graph for larger image.These graphs from Black Knight shows 90 day defaults vs. foreclosure starts.

From Black Knight:

• While total foreclosure starts are the lowest they’ve been since April 2005, at just 25,800, first time foreclosure starts are the lowest on record, dating back to at least 2000There is much more in the mortgage monitor.

• Reduced foreclosure starts in April are due in part to the seasonality of 90-day default activity. 90-day defaults typically hit their calendar year low in March leading to a month-over-month reduction in foreclosure starts in the month of April – observed in 10 of the past 12 years.

• Improved mortgage performance has also led to a reduction in foreclosure starts. March saw the lowest one month volume of 90-day defaults in 11 years, down 11 percent from last year and down 82 percent from the January 2009 peak

• Additionally, the ratio of new foreclosure starts to 90-day defaults is lower than pre-crisis norms, likely due to an increased focus on pre-foreclosure loss mitigation