by Calculated Risk on 3/12/2016 08:11:00 AM

Saturday, March 12, 2016

Schedule for Week of March 13, 2016

The key economic reports this week are February retail sales on Tuesday, and February housing starts on Wednesday.

For prices, PPI and CPI will be released this week.

From manufacturing, February Industrial Production and the March NY and Philly Fed manufacturing surveys will be released this week.

The FOMC meets this week, and the FOMC statement (and press conference) will be on Wednesday.

10:00 AM ET: Regional and State Employment and Unemployment (Monthly) for January 2016 from BLS.

8:30 AM ET: Retail sales for February will be released. The consensus is for retail sales to decrease 0.1% in February.

8:30 AM ET: Retail sales for February will be released. The consensus is for retail sales to decrease 0.1% in February.This graph shows retail sales since 1992 through January 2016. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline). On a monthly basis, retail sales were up 0.2% from December to January (seasonally adjusted), and sales were up 3.4% from January 2015.

8:30 AM: The Producer Price Index for February from the BLS. The consensus is for a 0.2% decrease in prices, and a 0.1% increase in core PPI.

8:30 AM: NY Fed Empire State Manufacturing Survey for March. The consensus is for a reading of -11.0, up from -16.7.

10:00 AM: The March NAHB homebuilder survey. The consensus is for a reading of 59, up from 58 in February. Any number above 50 indicates that more builders view sales conditions as good than poor.

10:00 AM: Manufacturing and Trade: Inventories and Sales (business inventories) report for January. The consensus is for no change in inventories.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Housing Starts for February.

8:30 AM: Housing Starts for February. Total housing starts decreased to 1.099 million (SAAR) in January. Single family starts decreased to 731 thousand SAAR in January.

The consensus for 1.146 million, up from the January rate.

8:30 AM: The Consumer Price Index for February from the BLS. The consensus is for a 0.3% decrease in CPI, and a 0.2% increase in core CPI.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for February.

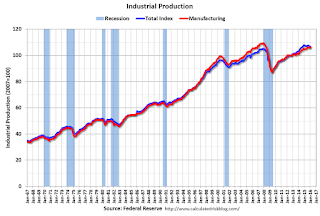

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for February.This graph shows industrial production since 1967.

The consensus is for a 0.2% decrease in Industrial Production, and for Capacity Utilization to decrease to 76.9%.

2:00 PM: FOMC Meeting Announcement. No change to the Fed Funds rate is expected at this meeting.

2:00 PM: FOMC Forecasts This will include the Federal Open Market Committee (FOMC) participants' projections of the appropriate target federal funds rate along with the quarterly economic projections.

2:30 PM: Fed Chair Janet Yellen holds a press briefing following the FOMC announcement.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 270 thousand initial claims, up from 259 thousand the previous week.

8:30 AM: the Philly Fed manufacturing survey for March. The consensus is for a reading of -1.4, up from -2.8.

10:00 AM: Job Openings and Labor Turnover Survey for January from the BLS.

10:00 AM: Job Openings and Labor Turnover Survey for January from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings increased in December to 5.607 million from 5.346 million in November.

The number of job openings (yellow) were up 15% year-over-year, and Quits were up 13% year-over-year.

10:00 AM: University of Michigan's Consumer sentiment index (preliminary for March). The consensus is for a reading of 92.2, up from 91.7 in February.