by Calculated Risk on 11/02/2015 02:08:00 PM

Monday, November 02, 2015

Fed Survey: Banks reports stronger demand for CRE loans

From the Federal Reserve: The October 2015 Senior Loan Officer Opinion Survey on Bank Lending Practices

Regarding loans to businesses, the October survey results indicated that, on balance, banks reported little change in their standards on commercial and industrial (C&I) loans in the third quarter of 2015. In addition, banks reported having eased some loan terms, such as spreads and loan maturities, on net. However, banks also indicated that they increased premiums charged on riskier loans for larger firms on net. With respect to commercial real estate (CRE) lending, on balance, survey respondents reported that standards on loans secured by nonfarm nonresidential properties, loans secured by multifamily residential properties, and construction and land development loans remained about unchanged. On the demand side, banks reported that demand for C&I loans was about unchanged, on balance, and moderate net fractions of survey respondents experienced stronger demand for all three categories of CRE loans during the third quarter.

Regarding loans to households, banks reported having eased lending standards on loans eligible for purchase by the government-sponsored enterprises and on qualified mortgage (QM) loans over the past three months on net. On balance, modest fractions of banks indicated having eased standards for credit card loans as well as for auto loans. On the demand side, modest net fractions of banks reported weaker demand across most categories of home-purchase loans. In contrast, respondents experienced stronger demand for credit card loans on net.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here are some charts from the Fed.

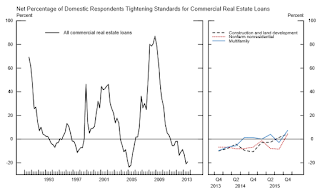

This graph shows the change in lending standards and for CRE (commercial real estate) loans.

Mostly standards were unchanged for various categories of CRE (right half of graph).

The second graph shows the change in demand for CRE loans.

Banks are seeing a pickup in demand for all categories of CRE - including multi-family.

Banks are seeing a pickup in demand for all categories of CRE - including multi-family.This suggests that we will see further increases in commercial real estate development.