by Calculated Risk on 11/05/2015 03:59:00 PM

Thursday, November 05, 2015

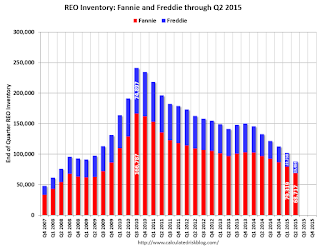

Fannie: REO inventory declined in Q3, Down 34% Year-over-year

The continued decrease in the number of our seriously delinquent single-family loans has resulted in a reduction in the number of REO acquisitions in the first nine months of 2015 as compared with the first nine months of 2014.Fannie is unable to currently market about 40% of their inventory (see table 32 on page 62 for status).

We continue to manage our REO inventory to appropriately manage costs and maximize sales proceeds. However, we are unable to market and sell a large portion of our inventory, primarily due to occupancy and state or local redemption or confirmation periods, which extends the amount of time it takes to bring our properties to a marketable state and eventually dispose of them. This results in higher foreclosed property expenses, which include costs related to maintaining the property and ensuring that the property is vacant. Before we market our foreclosed properties, we may choose to repair them in order to maximize the sales price and increase the likelihood that an owner occupant will purchase. In some cases, we engage in third party sales at foreclosure, which allow us to avoid maintenance and other REO expenses we would have incurred had we acquired the property.

emphasis added

Fannie and Freddie are still working through the backlog of loans made during the housing bubble, mostly in judicial foreclosure states.

Click on graph for larger image.

Click on graph for larger image.Here is a graph of Fannie and Freddie Real Estate Owned (REO).

REO inventory decreased in Q3 for both Fannie and Freddie, and combined inventory is down 35% year-over-year. For Freddie, this is the lowest level of REO since Q4 2007. For Fannie, this is the lowest level since Q2 2008.

Short term delinquencies are at normal levels, but there are still a number of properties in the foreclosure process with long time lines in judicial foreclosure states.