by Calculated Risk on 10/31/2015 01:01:00 PM

Saturday, October 31, 2015

Schedule for Week of November 1st

The key report this week is the October employment report on Friday.

Other key indicators include October vehicle sales, the October ISM manufacturing and non-manufacturing indexes, and the September trade deficit.

There will be several Federal Reserve speakers this week.

10:00 AM: ISM Manufacturing Index for October. The consensus is for the ISM to be at 50.0, down from 50.2 in September.

10:00 AM: ISM Manufacturing Index for October. The consensus is for the ISM to be at 50.0, down from 50.2 in September.Here is a long term graph of the ISM manufacturing index.

The ISM manufacturing index indicated expansion at 50.2% in September. The employment index was at 50.5%, and the new orders index was at 50.1%.

10:00 AM: Construction Spending for September. The consensus is for a 0.4% increase in construction spending.

2:00 PM ET: the October 2015 Senior Loan Officer Opinion Survey on Bank Lending Practices from the Federal Reserve.

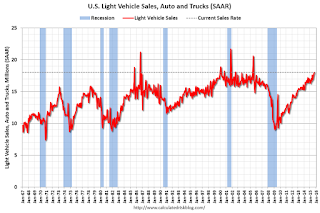

All day: Light vehicle sales for October. The consensus is for light vehicle sales to decrease to 17.7 million SAAR in October from 18.1 million in September (Seasonally Adjusted Annual Rate).

All day: Light vehicle sales for October. The consensus is for light vehicle sales to decrease to 17.7 million SAAR in October from 18.1 million in September (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the September sales rate.

10:00 AM: Manufacturers' Shipments, Inventories and Orders (Factory Orders) for September. The consensus is a 0.9% decrease in orders.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for October. This report is for private payrolls only (no government). The consensus is for 185,000 payroll jobs added in October, down from 200,000 in September.

8:30 AM: Trade Balance report for September from the Census Bureau.

8:30 AM: Trade Balance report for September from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through August. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is for the U.S. trade deficit to be at $41.1 billion in September from $48.3 billion in August.

10:00 AM: the ISM non-Manufacturing Index for October. The consensus is for index to decrease to 56.7 from 56.9 in September.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 262 thousand initial claims, up from 260 thousand the previous week.

8:30 AM: Employment Report for October. The consensus is for an increase of 190,000 non-farm payroll jobs added in October, up from the 142,000 non-farm payroll jobs added in September.

The consensus is for the unemployment rate to decrease to 5.0%.

This graph shows the year-over-year change in total non-farm employment since 1968.

This graph shows the year-over-year change in total non-farm employment since 1968.In September, the year-over-year change was 2.75 million jobs.

A key will be the change in real wages - and as the unemployment rate falls, wage growth should pickup.

3:00 PM: Consumer Credit for September from the Federal Reserve. The consensus is consumer credit increased by $18.0 billion in September.