by Calculated Risk on 8/03/2015 05:42:00 PM

Monday, August 03, 2015

Fed Survey: Banks reports stronger demand for Home-purchase loans and CRE Loans

From the Federal Reserve: The July 2015 Senior Loan Officer Opinion Survey on Bank Lending Practices

Regarding loans to businesses, the July survey results indicated that, on balance, banks reported little change in their standards on commercial and industrial (C&I) loans in the second quarter of 2015. In addition, banks reported having eased some loan terms, such as spreads and covenants, especially for larger firms on net. Meanwhile, survey respondents also reported that standards on commercial real estate (CRE) loans remained unchanged on balance. On the demand side, modest to moderate net fractions of banks indicated having experienced stronger demand for C&I and CRE loans during the second quarter.

Regarding loans to households, banks reported having eased lending standards for a number of categories of residential mortgage loans over the past three months on net. Most banks reported no change in standards and terms on consumer loans. On the demand side, moderate to large net fractions of banks reported stronger demand across most categories of home-purchase loans. Similarly, respondents experienced stronger demand for auto and credit card loans on net.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here are some charts from the Fed.

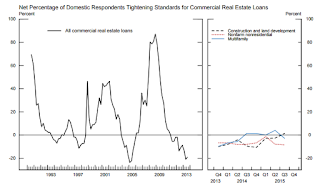

This graph shows the change in lending standards and for CRE (commercial real estate) loans.

Mostly standards were unchanged for various categories of CRE (right half of graph).

The second graph shows the change in demand for CRE loans.

Banks are seeing a pickup in demand for all categories of CRE - including multi-family.

Banks are seeing a pickup in demand for all categories of CRE - including multi-family.This suggests that we will see further increases in commercial real estate development.

Also the banks are easing credit a little for residential mortgages (see graph on page 3).