by Calculated Risk on 8/24/2015 01:47:00 PM

Monday, August 24, 2015

Catching Up: Housing Starts increased to 1.206 Million Annual Rate in July

While I was on vacation, there were several major economic releases. I'm catching up ...

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in July were at a seasonally adjusted annual rate of 1,206,000. This is 0.2 percent above the revised June estimate of 1,204,000 and is 10.1 percent above the July 2014 rate of 1,095,000.

Single-family housing starts in July were at a rate of 782,000; this is 12.8 percent above the revised June figure of 693,000. The July rate for units in buildings with five units or more was 413,000.

Building Permits:

Privately-owned housing units authorized by building permits in July were at a seasonally adjusted annual rate of 1,119,000. This is 16.3 percent below the revised June rate of 1,337,000, but is 7.5 percent above the July 2014 estimate of 1,041,000.

Single-family authorizations in July were at a rate of 679,000; this is 1.9 percent below the revised June figure of 692,000. Authorizations of units in buildings with five units or more were at a rate of 412,000 in July.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (red, 2+ units) decreased in July. Multi-family starts were down slightly year-over-year.

Single-family starts (blue) increased in July and are up about 19% year-over-year.

The second graph shows total and single unit starts since 1968.

The second graph shows the huge collapse following the housing bubble, and then - after moving sideways for a couple of years - housing is now recovering (but still historically low),

The second graph shows the huge collapse following the housing bubble, and then - after moving sideways for a couple of years - housing is now recovering (but still historically low),Total housing starts in July were above expectations, and, including the upward revisions to May and June, starts were solid - especially single family starts.

This third graph shows the month to month comparison between 2014 (blue) and 2015 (red).

Even with weak housing starts in February and March, total starts are still running 11.3% ahead of 2014 through July.

Even with weak housing starts in February and March, total starts are still running 11.3% ahead of 2014 through July.Single family starts are running 11.2% ahead of 2014 through July.

Starts for 5+ units are up 12.2% for the first six months compared to last year.

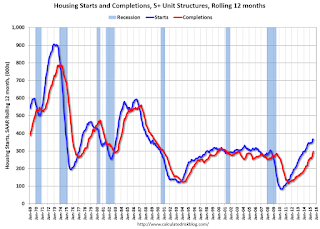

Below is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

The blue line is for multifamily starts and the red line is for multifamily completions.

The blue line is for multifamily starts and the red line is for multifamily completions. The rolling 12 month total for starts (blue line) increased steadily over the last few years, and completions (red line) have lagged behind - but completions have been catching up (more deliveries), and will continue to follow starts up (completions lag starts by about 12 months).

Multi-family completions are increasing sharply.

I think most of the growth in multi-family starts is probably behind us - in fact multi-family starts might have peaked - although I expect solid multi-family starts for a few more years (based on demographics).

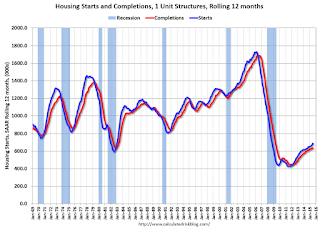

The second graph shows single family starts and completions. It usually only takes about 6 months between starting a single family home and completion - so the lines are much closer. The blue line is for single family starts and the red line is for single family completions.

The second graph shows single family starts and completions. It usually only takes about 6 months between starting a single family home and completion - so the lines are much closer. The blue line is for single family starts and the red line is for single family completions.Note the exceptionally low level of single family starts and completions. The "wide bottom" was what I was forecasting several years ago, and now I expect several years of increasing single family starts and completions.

A strong report, especially for single family starts.