by Calculated Risk on 7/02/2015 01:15:00 PM

Thursday, July 02, 2015

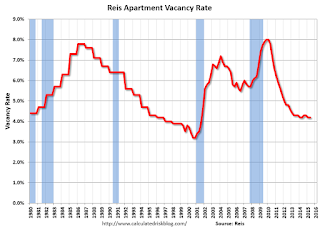

Reis: Apartment Vacancy Rate unchanged in Q2 at 4.2%

Reis reported that the apartment vacancy rate was unchanged in Q2 2015, compared to Q1, at 4.2% - and also the same as in Q2 2014. The vacancy rate peaked at 8.0% at the end of 2009.

A few comments from Reis Senior Economist and Director of Research Ryan Severino:

Vacancy was unchanged at 4.2% during the quarter with construction and net absorption effectively in balance. Vacancy is cyclical and moves in long phases. For most of the last five years, the market has been in a vacancy compression phase, falling from 8% at the start of 2010 before bottoming out at 4.2% during the first quarter of last year. However, since that time vacancy has been stuck at the 4.2% range for the sixth consecutive quarter. There could still be a quarter when vacancy falls slightly, but that would be an anomaly and not a trend. Clearly, the run of vacancy compression during this cycle is over. From this point forward, with supply projected to exceed demand, we anticipate that vacancy will rise, slowly at first and then more gradually as we move forward.

...

Asking and effective rents both grew by 1.0% during the second quarter. This was a rebound versus the first quarter when they both grew by about 0.6%. Although the apartment market typically exhibits some seasonality, which appears to be the case here, the longer vacancy remains at such low levels, the greater the probability that rent growth will remain this strong. Year‐over‐year rent growth for asking and effective rents have inched up around 3.5% and annualized rent growth during the quarter is around 4%. Both of these are well in excess of core inflation and ahead of any other property type.

...

Although construction continues to increase, we have yet to see the big surge in completions that we have been anticipating. That is not to downplay the relatively large amount of supply that continues to come online so much as it is to highlight the daunting situation yet to come. Even without construction volume leaping, vacancy compression has stalled. At 4.2% the national vacancy rate is unchanged over the last year and appears to have bottomed out. This intimates that once construction activity does increase demand is going to be unable to keep pace and vacancy will rise. Although demand remains relatively stout, construction volumes are set to test historically high levels in 2015. Therefore, the market should not become complacent because vacancy has yet to rise. In recent quarters we have seen an increase in the use of soft openings and push backs in completion dates. Both simply delay the inevitable – vacancy rates will rise. It is only a matter of time at this juncture.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the apartment vacancy rate starting in 1980. (Annual rate before 1999, quarterly starting in 1999). Note: Reis is just for large cities.

The vacancy rate is mostly moving sideways now. As completions catchup with starts, the vacancy rate will probably start increasing (See: Are Multi-Family Housing Starts near a peak?)

Apartment vacancy data courtesy of Reis.