by Calculated Risk on 5/04/2015 08:06:00 AM

Monday, May 04, 2015

Black Knight March Mortgage Monitor: "Negative Equity Population Shrinks to Just Over 4 Million"

Black Knight Financial Services (BKFS) released their Mortgage Monitor report for March today. According to BKFS, 4.70% of mortgages were delinquent in March, down from 5.36% in February. BKFS reported that 1.55% of mortgages were in the foreclosure process, down from 2.13% in March 2014.

This gives a total of 6.25% delinquent or in foreclosure. It breaks down as:

• 1,409,000 properties that are 30 or more days, and less than 90 days past due, but not in foreclosure.

• 971,000 properties that are 90 or more days delinquent, but not in foreclosure.

• 782,000 loans in foreclosure process.

For a total of 3,162,000 loans delinquent or in foreclosure in March. This is down from 3,840,000 in March 2014.

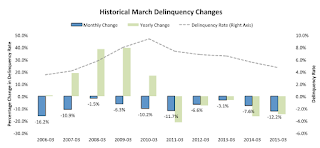

Typically there is a large decline in the March delinquency rate, but the decline this year was especially large.

From Black Knight:

March’s 12.2 percent drop in delinquency rates was the largest monthly decline in 9 yearsAlso from Black Knight on negative equity:

Delinquencies were down approximately 15 percent year-over-year

While seasonal decreases in March are typical (they’ve been seen in each of the past 10 years), this year’s drop was the largest since the 16.2 percent decline seen in March of 2006

Black Knight analyzed the latest available data on the nation’s negative equity situation. As explained by Ben Graboske, senior vice president, Black Knight Data and Analytics, the trend remains one of overall improvement – though negative equity distribution varies considerably depending upon geographical location and home values within a given market.

...

“Our most recent data shows that just over 8 percent of borrowers are currently underwater on their mortgages, representing a nearly 30 percent reduction in the negative equity rate since last year. We also observed that 29 percent of underwater borrowers are seriously delinquent on their mortgages and that borrowers in negative equity positions make up 77 percent of all active foreclosures. In fact, one of every three borrowers in active foreclosure has a current loan-to-value ratio of 150 or more, meaning they owe 50 percent more than their homes are worth." [said Graboske.]

Just over 4 million borrowers (8.08 percent of active mortgage universe) are in a negative equity position as of January 2015There is much more in the mortgage monitor.

Last year this population stood at 5.7 million borrowers (11.4 percent), marking a reduction of nearly 29 percent, or 1.6 million fewer underwater borrowers in 2015

The current population of underwater borrowers is just a quarter of the negative equity population at its peak in early 2011 (when 30 percent of borrowers were in negative equity positions)