by Calculated Risk on 2/25/2015 05:42:00 PM

Wednesday, February 25, 2015

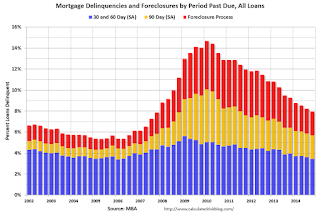

MBA: Mortgage Delinquency and Foreclosure Rates Decrease in Q4, Lowest since 2007

Earlier from the MBA: Mortgage Delinquencies Continue to Decrease in Fourth Quarter

The delinquency rate for mortgage loans on one-to-four-unit residential properties decreased to a seasonally adjusted rate of 5.68 percent of all loans outstanding at the end of the fourth quarter of 2014. This was the lowest level since the third quarter of 2007. The delinquency rate decreased 17 basis points from the previous quarter, and 71 basis points from one year ago, according to the Mortgage Bankers Association’s (MBA) National Delinquency Survey.

The delinquency rate includes loans that are at least one payment past due but does not include loans in the process of foreclosure. The percentage of loans in the foreclosure process at the end of the fourth quarter was 2.27 percent, down 12 basis points from the third quarter and 59 basis points lower than the same quarter one year ago. This was the lowest foreclosure inventory rate seen since the fourth quarter of 2007.

...

“Delinquency rates and the percentage of loans in foreclosure decreased for another quarter and were at their lowest levels since 2007,” said Marina Walsh, MBA’s Vice President of Industry Analysis. “We are now back to pre-crisis levels for most measures.”

Walsh continued: “The foreclosure inventory rate has decreased every quarter since the second quarter of 2012, and is now at the lowest level since the fourth quarter of 2007. Foreclosure starts ticked up two basis points, after being flat last quarter, largely due to state-level fluctuations in the speed of the foreclosure process. Compared to the same quarter last year, foreclosure starts are down eight basis points.

“At the state level, 45 states saw a decline in their foreclosure inventory rates over the quarter, although judicial states continue to account for a disproportionately high share. Fewer than half the states had an increase in non-seasonally adjusted 30 day delinquencies, which is highly seasonal and usually increases in the fourth quarter. Foreclosure starts increased in 28 states, but this has become more volatile, with recent state-level mediation requirements and changing laws, as well as servicer procedures, dictating the changes from quarter to quarter.

“States that utilize a judicial foreclosure process continue to have a foreclosure inventory rate that is roughly three times that of non-judicial states. For states where the judicial process is more frequently used, 3.79 percent of loans were in the foreclosure process, compared to 1.23 percent in non-judicial states. States that utilize both judicial and non-judicial foreclosure processes had a foreclosure inventory rate closer that of to the non-judicial states at 1.43 percent.

“Legacy loans continue to account for the bulk of all troubled mortgages. Within loans that were seriously delinquent (either more than 90 days delinquent or in the foreclosure process), 73 percent of those loans were originated in 2007 and earlier. More recent loan cohorts, specifically loans originated in 2012 and later, continue to exhibit low serious delinquency rates.

“We expect the improvement in mortgage performance to continue due to the improving economy and a strengthening job market, and the improved credit quality of recent vintages.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of loans delinquent by days past due.

The percent of loans 30 and 60 days delinquent are back to normal levels.

The 90 day bucket peaked in Q1 2010, and is about 70% of the way back to normal.

The percent of loans in the foreclosure process also peaked in 2010 and and is about two-thirds of the way back to normal.

So it has taken about 4 years to reduce the backlog of seriously delinquent and in-foreclosure loans by two-thirds, so a rough guess is that serious delinquencies and foreclosure inventory will be back to normal in a couple more years. Most other measures are already back to normal (still working through the backlog of bubble legacy loans).