by Calculated Risk on 10/21/2014 11:02:00 AM

Tuesday, October 21, 2014

A Few Comments on September Existing Home Sales

A few comments ...

• Once again housing economist Tom Lawler's forecast of 5.14 million SAAR was closer than the consensus (5.05 million) to the NAR reported sales (5.17 million). It is getting harder for Lawler to beat the "consensus" because it appears several analysts are waiting for Lawler's estimate before submitting their own!

• "The sky is falling! The sky is falling!" Maybe not ... Remember those analysts who incorrectly claimed that declining year-over-year existing home sales were a sign that the "housing recovery" was over? That was wrong, and I correctly pointed out: 1) the "housing recovery" is mostly new home sales and housing starts - not existing home sales, 2) declining overall existing home sales were a positive if the decline was related to fewer distressed sales.

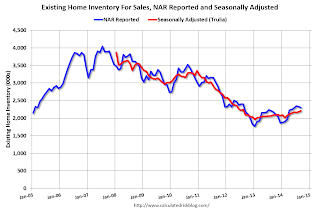

• The most important number in the NAR report each month is inventory. This morning the NAR reported that inventory was up 6.0% year-over-year in September. It is important to note that the NAR inventory data is "noisy" and difficult to forecast based on other data.

The headline NAR inventory number is not seasonally adjusted, even though there is a clear seasonal pattern. Trulia chief economist Jed Kolko has sent me the seasonally adjusted inventory. NOTE: The NAR does provide a seasonally adjusted months-of-supply, although that is in the supplemental data.

This shows that inventory bottomed in January 2013 (on a seasonally adjusted basis), and inventory is now up about 12.5% from the bottom. On a seasonally adjusted basis, inventory was up 1.4% in September compared to August.

Important: The NAR reports active listings, and although there is some variability across the country in what is considered active, many "contingent short sales" are not included. "Contingent short sales" are strange listings since the listings were frequently NEVER on the market (they were listed as contingent), and they hang around for a long time - they are probably more closely related to shadow inventory than active inventory. However when we compare inventory to 2005, we need to remember there were no "short sale contingent" listings in 2005. In the areas I track, the number of "short sale contingent" listings is also down sharply year-over-year.

And it appears investor buying is declining year-over-year. From the NAR:

All-cash sales were 24 percent of transactions in September, up slightly from August (23 percent) but down from 33 percent in September of last year. Individual investors, who account for many cash sales, purchased 14 percent of homes in September, up from 12 percent last month but below September 2013 (19 percent). Sixty-three percent of investors paid cash in September.And another key point: The NAR reported total sales were down 1.7% from September 2013, but normal equity sales were probably up year-over-year, and distressed sales down sharply. From the NAR (from a survey that is far from perfect):

Distressed homes – foreclosures and short sales – increased slightly in September to 10 percent from 8 percent in August, but are down from 14 percent a year ago. Seven percent of September sales were foreclosures and 3 percent were short sales.Last year in September the NAR reported that 14% of sales were distressed sales.

A rough estimate: Sales in September 2013 were reported at 5.26 million SAAR with 14% distressed. That gives 740 thousand distressed (annual rate), and 4.52 million equity / non-distressed. In September 2014, sales were 5.17 million SAAR, with 10% distressed. That gives 520 thousand distressed - a decline of about 30% from September 2013 - and 4.65 million equity. Although this survey isn't perfect, this suggests distressed sales were down sharply - and normal sales up slightly.

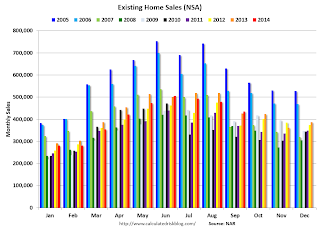

The following graph shows existing home sales Not Seasonally Adjusted (NSA).

Click on graph for larger image.

Click on graph for larger image.Sales NSA in September (red column) were at the highest level for September since 2006.

Overall this was a solid report.

Earlier:

• Existing Home Sales in September: 5.17 million SAAR, Inventory up 6.0% Year-over-year