by Calculated Risk on 9/17/2014 07:01:00 AM

Wednesday, September 17, 2014

MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 7.9 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending September 12, 2014. The previous week’s results included an adjustment for the Labor Day holiday. ...

The Refinance Index increased 10 percent from the previous week. The seasonally adjusted Purchase Index increased 5 percent from one week earlier. ...

...

“Application volume rebounded coming out of the Labor Day holiday, even as rates increased to their highest level in the last few months,” said Mike Fratantoni, MBA’s Chief Economist. “Given the volatility in activity around the long weekend, it can be helpful to look at the change over a two week span: refinance applications are down 1.4 percent while purchase applications are up 2.1 percent. Purchase volume continues to track almost ten percent behind last year’s levels.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) increased to 4.36 percent, the highest level since June 2014, from 4.27 percent, with points decreasing to 0.20 from 0.25 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

The refinance index is down 74% from the levels in May 2013.

As expected, refinance activity is very low this year.

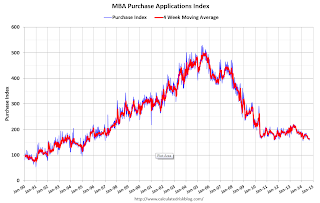

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is down about 10% from a year ago.