by Calculated Risk on 9/05/2014 09:50:00 AM

Friday, September 05, 2014

Comments on Employment Report

Earlier: August Employment Report: 142,000 Jobs, 6.1% Unemployment Rate

Although the headline number and revisions were disappointing, this is just one month of data and historically the employment report is "noisy".

There were some positives in the report: the unemployment rate declined to 6.1%, U-6 (an alternative measure for labor underutilization) was at the lowest level since 2008, the number of part time workers for economic reasons declined, the number of long term unemployed declined to the lowest level since January 2009 - and payroll growth is still on pace to be the best year since 1999.

At the current pace (through August), the economy will add 2.58 million jobs this year (2.52 million private sector jobs). Right now 2014 is still on pace to be the best year for both total and private sector job growth since 1999.

Although wage growth is still subdued, it appears wage growth has picked up a little recently. From the BLS: "Average hourly earnings for all employees on private nonfarm payrolls rose by 6 cents in August to $24.53. Over the year, average hourly earnings have risen by 2.1 percent." With the unemployment rate at 6.1%, there is still little upward pressure on wages. Wages should pick up as the unemployment rate falls over the next couple of years, but with the currently low inflation and little wage pressure, the Fed will likely remain patient.

A few numbers:

Total employment increased 142,000 from July to August, and is now 753,000 above the previous peak. Total employment is up 9.463 million from the employment recession low.

Private payroll employment increased 134,000 from July to August, and private employment is now 1,244,000 above the previous peak (the unprecedented large number of government layoffs has held back total employment). Private employment is up 10.03 million from the low.

Through the first eight months of 2014, the economy has added 1,723,000 payroll jobs - up from 1,572,000 added during the same period in 2013. My expectation at the beginning of the year was the economy would add between 2.4 and 2.7 million payroll jobs this year. That still looks about right.

Employment-Population Ratio, 25 to 54 years old

In the earlier period the participation rate for this group was trending up as women joined the labor force. Since the early '90s, the participation rate has mostly moved sideways (with a downward drift started around '00) - and with ups and downs related to the business cycle.

The 25 to 54 participation rate increased in August to 81.1% from 80.8% in July, and the 25 to 54 employment population ratio increased to 76.8% from 76.7%. As the recovery continues, I expect the participation rate for this group to increase - although the participation rate has been trending down for this group since the '90s.

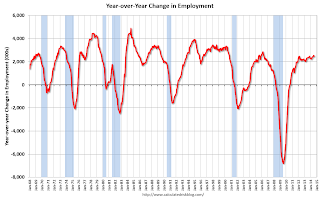

Year-over-year Change in Employment

In August, the year-over-year change was 2.482 million jobs, and it generally appears the pace of hiring is increasing.

Right now it looks possible that 2014 will be the best year since 1999 for both total nonfarm and private sector employment growth.

Part Time for Economic Reasons

The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers) was little changed in August at 7.3 million. These individuals were working part time because their hours had been cut back or because they were unable to find a full-time job.The number of persons working part time for economic reasons decreased in August to 7.277 million from 7.511 million in July. This suggests significantly slack still in the labor market. These workers are included in the alternate measure of labor underutilization (U-6) that decreased to 12.0% in August from 12.2% in July.

This is the lowest level for U-6 since October 2008.

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 2.963 million workers who have been unemployed for more than 26 weeks and still want a job. This was down from 3.155 in July. This is generally trending down, but is still very high.

This is the lowest level for long term unemployed since January 2009.

State and Local Government

This graph shows total state and government payroll employment since January 2007. State and local governments lost jobs for four straight years. (Note: Scale doesn't start at zero to better show the change.)

This graph shows total state and government payroll employment since January 2007. State and local governments lost jobs for four straight years. (Note: Scale doesn't start at zero to better show the change.) In August 2014, state and local governments added 5,000 jobs. State and local government employment is now up 123,000 from the bottom, but still 621,000 below the peak.

It is pretty clear that state and local employment is now increasing. Federal government layoffs have slowed (payroll increased slightly in August), but Federal employment is still down 19,000 for the year.