by Calculated Risk on 6/28/2014 08:15:00 AM

Saturday, June 28, 2014

Unofficial Problem Bank list declines to 468 Institutions, Q2 2014 Transition Matrix

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for June 27, 2014.

Changes and comments from surferdude808:

FDIC providing an update on its enforcement action activities and a deeper scrubbing of the list drove a net decline in the Unofficial Problem Bank List to 468 institutions with assets of $149.2 billion. In all, there were 21 removals and one addition this week. A year ago, the list held 749 institutions with assets of $273.3 billion. During this June, the list declined by a net 28 institutions after 26 action terminations, two failures, one merger, and one addition. The failure this week, The Freedom State Bank, Freedom, OK surprisingly was not on the list as the only action issued by FDIC that can be located is a Prompt Corrective Action order only issued less than 60 days ago.

Removals this week were The Bank of Delmarva, Seaford, DE ($425 million); Community Bank of the South, Smyrna, GA ($348 million); Mercantile Bank, Quincy, IL ($347 million); The Pueblo Bank and Trust Company, Pueblo, CO ($320 million); First Farmers & Merchants Bank, Cannon Falls, MN ($265 million); Firstier Bank, Kimball, NE ($245 million); SouthPoint Bank, Birmingham, AL ($202 million); Marine Bank & Trust Company, Vero Beach, FL ($152 million); Bank of Fairfield, Fairfield, WA ($147 million); Concord Bank, St. Louis, MO ($138 million); Town & Country Bank, Las Vegas, NV ($120 million); Freedom Bank of America, Saint Petersburg, FL ($107 million); State Bank of Park Rapids, Park Rapids, MN ($100 million); Community Pride Bank, Isanti, MN ($94 million); First Bank, West Des Moines, IA ($90 million); First Carolina Bank, Rocky Mount, NC ($89 million); Sherburne State Bank, Becker, MN ($84 million); Bank of the Prairie, Olathe, KS ($80 million); Security Bank, New Auburn, WI ($75 million); Holladay Bank & Trust, Salt Lake City, UT ($51 million); and Maple Bank, Champlin, MN ($51 million).

The sole addition this week Community 1st Bank Las Vegas, Las Vegas, NM ($146 million).

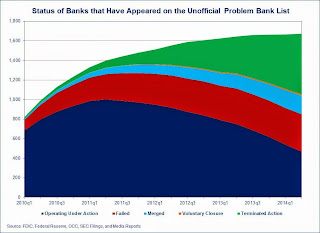

We have updated the Unofficial Problem Bank List transition matrix through the second quarter of 2014. Full details are available in the accompanying table and a graphic depicting trends in how institutions have arrived and departed the list. Since publication of the Unofficial Problem Bank List started in August 2009, a total of 1,672 institutions have appeared on the list. New entrants have slowed since late 2012, but this quarter seven institutions were added up from only three being added in the previous two quarters.

At the end of the second quarter, only 468 or 28 percent of the banks that have been on a list at some point remain. Action terminations of 619 account for around 51 percent of the 1,204 institutions removed. However, a significant number of institutions have left the list through failure. So far, 381 institutions have failed accounting for nearly 32 percent of departures. Should another institution on the list not fail, then more than 22 percent of the 1,672 institutions making an appearance would have failed. A 22 percent default rate would be more than double the rate often cited by media reports on the failure rate of banks on the FDIC's official list.

| Unofficial Problem Bank List | |||

|---|---|---|---|

| Change Summary | |||

| Number of Institutions | Assets ($Thousands) | ||

| Start (8/7/2009) | 389 | 276,313,429 | |

| Subtractions | |||

| Action Terminated | 141 | (55,759,559) | |

| Unassisted Merger | 32 | (6,697,723) | |

| Voluntary Liquidation | 4 | (10,584,114) | |

| Failures | 154 | (184,269,578) | |

| Asset Change | (5,411,792) | ||

| Still on List at 6/30/2014 | 58 | 13,590,663 | |

| Additions after 8/7/2009 | 478 | 135,599,760 | |

| End (6/30/2014) | 468 | 149,190,423 | |

| Intraperiod Deletions1 | |||

| Action Terminated | 478 | 206,393,188 | |

| Unassisted Merger | 158 | 71,031,845 | |

| Voluntary Liquidation | 10 | 2,324,142 | |

| Failures | 227 | 111,634,071 | |

| Total | 873 | 391,383,246 | |

| 1Institution not on 8/7/2009 or 6/30/2014 list but appeared on a weekly list. | |||