by Calculated Risk on 2/21/2014 12:46:00 PM

Friday, February 21, 2014

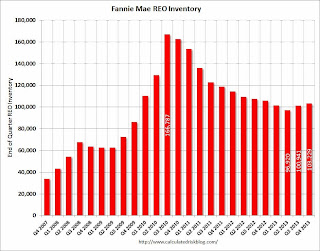

Fannie Results, REO Inventory increases in Q4

From Fannie Mae: Fannie Mae Reports Comprehensive Income of $84.8 Billion for 2013 and $6.6 Billion for Fourth Quarter 2013

Fannie Mae reported annual net income for 2013 of $84.0 billion, which includes the release of the company’s valuation allowance against its deferred tax assets, and annual pre-tax income for 2013 of $38.6 billion.Here are some summary stats on Fannie’s single family REO activity.

Fannie Mae will pay Treasury $7.2 billion in dividends in March 2014. With the March dividend payment, Fannie Mae will have paid a total of $121.1 billion in dividends to Treasury in comparison to $116.1 billion in draw requests since 2008. Dividend payments do not offset prior Treasury draws.

...

While Fannie Mae expects to be profitable for the foreseeable future, the company does not expect to repeat its 2013 financial results, as those results were positively affected by the release of the company’s valuation allowance against its deferred tax assets, a significant increase in home prices during the year, and the large number of resolutions the company reached relating to representation and warranty matters and servicing matters.

emphasis added

| Fannie SF REO Activity | |||

|---|---|---|---|

| Acquisitions | Dispositions | Inventory | |

| Q3/09 | 40,959 | 31,299 | 72,275 |

| Q4/09 | 47,189 | 33,309 | 86,155 |

| Q1/10 | 61,929 | 38,095 | 109,989 |

| Q2/10 | 68,838 | 49,517 | 129,310 |

| Q3/10 | 85,349 | 47,872 | 166,787 |

| Q4/10 | 45,962 | 50,260 | 162,489 |

| Q1/11 | 53,549 | 62,814 | 153,224 |

| Q2/11 | 53,697 | 71,202 | 135,719 |

| Q3/11 | 45,194 | 58,297 | 122,616 |

| Q4/11 | 47,256 | 51,344 | 118,528 |

| Q1/12 | 47,700 | 52,071 | 114,157 |

| Q2/12 | 43,783 | 48,674 | 109,266 |

| Q3/12 | 41,884 | 43,925 | 107,225 |

| Q4/12 | 41,112 | 42,671 | 105,666 |

| Q1/13 | 38,717 | 42,934 | 101,449 |

| Q2/13 | 36,106 | 40,635 | 96,920 |

| Q3/13 | 37,353 | 33,332 | 100,941 |

| Q4/13 | 32,208 | 29,920 | 103,229 |

Click on graph for larger image.

Click on graph for larger image.Here is a graph of Fannie REO. This was the second consecutive quarterly increase in REO.

Fannie’s SF REO inventory increased in Q4 mostly because of a decline in REO dispositions. Fannie reported the decline in acquisitions was related to long time lines in certain states (judicial foreclosure process). It is unclear why there was a sharp decline in dispositions over the last two quarters.