by Calculated Risk on 1/31/2014 01:48:00 PM

Friday, January 31, 2014

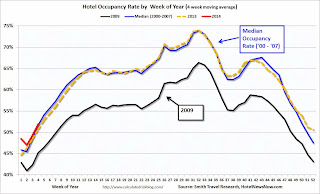

Hotel Occupancy Rate increased 2.4% year-over-year in latest Survey

From HotelNewsNow.com: STR: US results for week ending 25 January

The U.S. hotel industry posted positive results in the three key performance measurements during the week of 19-25 January 2014, according to data from STR.The 4-week average of the occupancy rate is close to normal levels.

In year-over-year measurements, the industry’s occupancy increased 2.4 percent to 55.2 percent. Average daily rate rose 3.0 percent to finish the week at US$109.59. Revenue per available room for the week was up 5.5 percent to finish at US$60.54.

emphasis added

Note: ADR: Average Daily Rate, RevPAR: Revenue per Available Room.

The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

Click on graph for larger image.

Click on graph for larger image.The red line is for 2014 and black is for 2009 - the worst year since the Great Depression for hotels.

Through January 25th, the 4-week average of the occupancy rate is slightly higher than the same period last year and is tracking at pre-recession levels.

This is expected to be another solid year for the hotel industry. In response to the improved metrics, the AIA expects hotel construction to increase significantly in 2014: Nonresidential Building Activity Projected to Accelerate in 2014

Led by the hotel ... the commercial sector looks to see the biggest gains in construction spending, with demand for institutional projects increasing at a more moderate level.Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

...

“Since the overall economy is stabilizing, there should be a significant improvement in the outlook for the construction industry that has been recovering at a slow and steady pace the last two years,” said AIA Chief Economist, Kermit Baker, PhD, Hon. AIA. “At a more granular level, the surging housing market, growing commercial property values, and declining office and retail vacancies are all contributing to what is expected to amount to a much greater spending on nonresidential building projects.”