by Calculated Risk on 12/11/2013 04:37:00 PM

Wednesday, December 11, 2013

Lawler on Fed Note: “Business Investor Activity in the Single-Family-Housing Market”

Economist Tom Lawler writes:

A “FEDS Note” (by Fed economists Malloy and Zarutskie), available on the Federal Reserve’s website, Business Investor Activity in the Single-Family-Housing Market, is a brief note on purchases of SF homes by “business investors” over the past few years. The data are based on an analysis of CoreLogic real estate transactions by analysts at Amherst Holdings. While the note does not give details on how a “business investor” was determined, the note says that this determination was made by looking at the names of the buyers of record. A link to the chart says that “(b)usiness investors are defined as business entities identified as purchasing homes for primarily for the purpose of earning a financial return.”

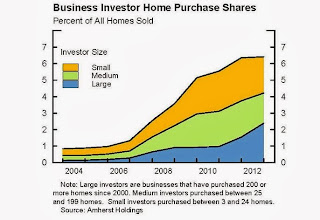

Here is a chart from the report on the Business Investor share of national home purchases.

As noted above, this chart only reflects the BUSINESS INVESTOR” share of home purchases, and does not include INDIVIDUAL investors. Back in 2004 and 2005 the investor share of mortgage-financed home purchases was extremely high, with such purchases mainly being by individuals (many of whom purchased multiple properties.)

At first glance this share increase, while noticeable, may not seem “large.” However, these shares suggest that business investor purchase of SF homes from 2010 to 2013 (using full-year estimates for 2013) totaled over 950,000, more than double the total number of business investor purchases over the previous SIX years (2004-2009). If the bulk of these business investor purchases were bought with the intent to rent the properties out for “several” years, then the sharp decline in the number of residential properties from 2010 to early 2013 seems a bit more “explainable.”

The note has a table showing the business-investor share of SF home purchases for selected metro areas.

CR Note: The metro areas with the largest share of investor buying in 2012 were Atlanta at 16.43%, Phoenix at 13.99% and Las Vegas at 10.97%.