by Calculated Risk on 11/07/2013 12:48:00 PM

Thursday, November 07, 2013

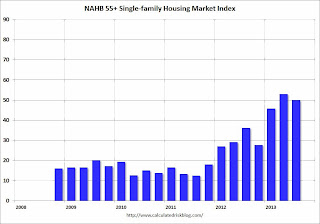

NAHB: Builder Confidence improves year-over-year in the 55+ Housing Market in Q3

This is a quarterly index from the the National Association of Home Builders (NAHB) and is similar to the overall housing market index (HMI). The NAHB started this index in Q4 2008, so the readings have been very low.

From the NAHB: Builder Confidence in the 55+ Housing Market Continues to Improve in Third Quarter

Builder confidence in the 55+ housing market showed continued improvement in the third quarter of 2013 compared to the same period a year ago, according to the National Association of Home Builders’ (NAHB) latest 55+ Housing Market Index (HMI) released today. All segments of the market—single-family homes, condominiums and multifamily rental—registered strong increases. The single-family index increased 14 points to a level of 50, which is the highest third-quarter number since the inception of the index in 2008 and the eighth consecutive quarter of year over year improvements. [CR Note: NAHB is reporting the year-over-year increase]

...

All of the components of the 55+ single-family HMI showed considerable growth from a year ago: present sales climbed 16 points to 52, expected sales for the next six months rose 11 points to 53 and traffic of prospective buyers increased 10 points to 43.

...

“Right now the positive year over year increase in confidence by builders for the 55+ market is tracking right along with other segments of the home building industry,” said NAHB Chief Economist David Crowe. “And like other segments of the industry, the 55+ market is improving in part because consumers are more likely to be able to sell their current homes, which allows them to buy a new home or move into an apartment that suits their specific needs.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the NAHB 55+ HMI through Q3 2013. The index declined in Q3 to 50 from 53 in Q2 - however the index is up solidly year-over-year. This indicates that about the same numbers builders view conditions as good than as poor.

This is going to be a key demographic for household formation over the next couple of decades, but only if the baby boomers can sell their current homes.

There are two key drivers: 1) there is a large cohort moving into the 55+ group, and 2) the homeownership rate typically increases for people in the 55 to 70 year old age group. So demographics should be favorable for the 55+ market.