by Calculated Risk on 5/15/2013 08:18:00 AM

Wednesday, May 15, 2013

MBA: Mortgage Applications Decrease in Weekly Survey

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

The Refinance Index decreased 8 percent from the previous week. The seasonally adjusted Purchase Index decreased 4 percent from one week earlier.

...

After declining for seven weeks straight, the average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) increased to 3.67 percent from 3.59 percent,with points increasing to 0.41 from 0.33 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans. This rate is at its highest level since the week ending April 12, 2013.

The average contract interest rate for 30-year fixed-rate mortgages with jumbo loan balances (greater than $417,500) increased to 3.87 percent from 3.79 percent, with points increasing to 0.25 from 0.20 (including the origination fee) for 80 percent LTV loans.

emphasis added

Click on graph for larger image.

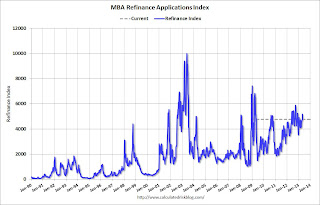

Click on graph for larger image.The first graph shows the refinance index.

There has been a sustained refinance boom for over a year.

The decline this week offset the sharp increase last week.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index has generally been trending up over the last year, and the 4-week average of the purchase index is just off the high for the year set last week.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index has generally been trending up over the last year, and the 4-week average of the purchase index is just off the high for the year set last week.