by Calculated Risk on 4/04/2013 12:02:00 PM

Thursday, April 04, 2013

Reis: Mall Vacancy Rate declines in Q1

Reis reported that the vacancy rate for regional malls declined to 8.3% in Q1, down from 8.6% in Q4 2012. This is down from a cycle peak of 9.4% in Q3 2011.

For Neighborhood and Community malls (strip malls), the vacancy rate declined slightly to 10.6% in Q1, down from 10.7% in Q4 2012. For strip malls, the vacancy rate peaked at 11.1% in Q3 2011.

Comments from Reis Senior Economist Ryan Severino:

[Strip Malls] Yet again, vacancy declined by only 10 bps during the first quarter. Although it is welcome that vacancy continues to decline on an almost quarterly basis, there is still no acceleration in vacancy compression. On a year‐over‐year basis, the vacancy rate declined by only 30 bps. Net absorption continues to outpace new construction, marginally pushing vacancy rates downward. With only 873,000 square feet delivered, even moderate demand for space would result in meaningful declines in the national vacancy rate. Yet despite the dearth of new completions, demand remains insufficient to make a meaningful dent in what is still an elevated vacancy rate.

...

[New construction] With retail sales struggling to recover and muted demand for space, new construction remained near record‐low levels during the quarter. 873,000 square feet were delivered during the first quarter, versus 1.231 million square feet during the fourth quarter. However, this is a slowdown compared to the 2.051 million square feet of retail space that were delivered during the first quarter of 2012. In fact, 873,000 square feet is the fourth‐lowest figure on record since Reis began tracking quarterly data in 1999. With demand for space remaining at abject levels, there exists virtually no incentive to develop new projects. 873,000 square feet is the equivalent of one or two medium‐sized properties.

...

[Regional] Once again, malls outperformed their neighborhood and community shopping center brethren. The national vacancy rate declined by another 30 basis points during the quarter. This is the sixth consecutive quarter with a vacancy decline. Asking rent growth accelerated versus last quarter, growing by another 0.4%. This was the eighth consecutive quarter of asking rent increases. The improvement in mall subsector picked up some pace during the first quarter. The thirty basis point compression in vacancy is the largest since the first quarter of 2003 and the 0.4% asking rent increase is the largest since the first quarter of 2008. However, as we have stated in quarters past, the recovery in the mall subsector is being driven by Dominant/Class A malls, which typically boast luxury retailers and cater to affluent consumers. This belies the fact that the remainder of the mall sector continues to struggle.

Click on graph for larger image.

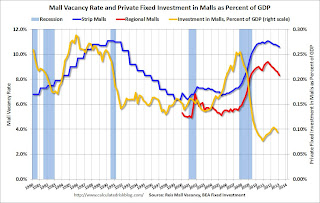

Click on graph for larger image.This graph shows the strip mall vacancy rate starting in 1980 (prior to 2000 the data is annual). The regional mall data starts in 2000. Back in the '80s, there was overbuilding in the mall sector even as the vacancy rate was rising. This was due to the very loose commercial lending that led to the S&L crisis.

In the mid-'00s, mall investment picked up as mall builders followed the "roof tops" of the residential boom (more loose lending). This led to the vacancy rate moving higher even before the recession started. Then there was a sharp increase in the vacancy rate during the recession and financial crisis.

The yellow line shows mall investment as a percent of GDP through Q4. This has increased from the bottom because this includes renovations and improvements. New mall investment has essentially stopped.

The good news is, as Severino noted, new square footage is near a record low, and with very little new supply, the vacancy rate will probably continue to decline slowly.

Mall vacancy data courtesy of Reis.