by Calculated Risk on 4/10/2013 10:09:00 AM

Wednesday, April 10, 2013

MBA: Mortgage Applications Increase, Conventional Purchase Applications highest since October 2009

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

The Refinance Index increased 6 percent from the previous week. The seasonally adjusted Purchase Index decreased 1 percent from one week earlier.

...

“Although total purchase application volume fell last week, there was a significant divergence between the conventional and government markets,” said Mike Fratantoni, MBA’s Vice President of Research and Economics. “Following the April 1 increase in FHA mortgage insurance premiums, government purchase applications fell by almost 14 percent, to their lowest level since February 2013. On the other hand, applications for conventional purchase loans increased by more than 5 percent, bringing the conventional purchase index to its highest level since October 2009 and the highest level since the expiration of the homebuyer tax credit. With these changes, the government share of all purchase loans fell to 30 percent, the lowest level since we began tracking this series in 2011.”

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) decreased to 3.68 percent, the lowest rate since January 2013, from 3.76 percent, with points remaining unchanged at 0.43 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

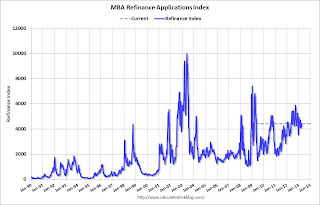

Click on graph for larger image.The first graph shows the refinance index.

There has been a sustained refinance boom for over a year.

Refinance activity will probably slow in 2013.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index has generally been trending up (slowly) over the last year.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index has generally been trending up (slowly) over the last year. As Fratantoni noted, conventional purchase activity is at the highest level since the expiration of the homebuyer tax credit.