by Calculated Risk on 3/20/2013 08:07:00 AM

Wednesday, March 20, 2013

MBA: Mortgage Applications decrease

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

The Refinance Index decreased 8 percent from the previous week. The seasonally adjusted Purchase Index decreased 4 percent from one week earlier.

...

The refinance share of mortgage activity decreased to 75 percent of total applications from 76 percent the previous week.The refinance share has decreased for ten straight weeks and is at its lowest level since early May 2012. ... The HARP share of refinance applications increased to 31 percent from 30 percent the prior week.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) increased to 3.82 percent from 3.81 percent, with points decreasing to 0.38 from 0.39 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

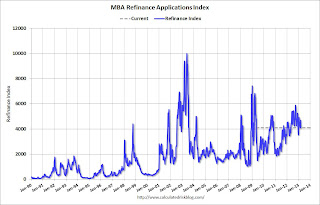

Click on graph for larger image.The first graph shows the refinance index.

There has been a sustained refinance boom for over a year, but activity has been declining over the last few months.

Refinance activity will probably slow in 2013.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index has generally been trending up (slowly) over the last year.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index has generally been trending up (slowly) over the last year.