by Calculated Risk on 2/08/2013 10:31:00 AM

Friday, February 08, 2013

Meyer on Construction Jobs

Last week I posted an article from Trulia chief economist Jed Kolko: Here are the “Missing” Construction Jobs. Here is another projection from Merrill Lynch economist Michelle Meyer: Construction Coming Back

One of the puzzles last year was the lack of hiring in the construction sector. Despite a 25% gain in housing starts, only a net 18,000 construction jobs were added for the year. This seemed too low, and we learned that evidently it was. The revisions yielded another 73,000 construction jobs in 2012 and 75,000 in 2011, bringing the total to 91,000 and 144,000, respectively.

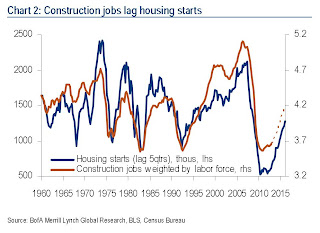

We think construction hiring will ramp up this year. The best way to forecast construction jobs is to look at the lagged impact of housing starts or residential investment. This comparison is easiest if we adjust construction employment for the size of the labor force. We find that the correlation between construction jobs and housing starts is the highest at 72% when housing starts are lagged by five quarters (Chart 2). Since housing starts reached a trough in 1Q11, construction jobs should have turned higher last spring. We saw some gains, but only very modest ones (which we learned after last month’s revision). The gain in housing starts accelerated in 2012, suggesting a faster pickup in construction jobs this year.

Click on graph for larger image.

Click on graph for larger image.Timing the turn is much easier than estimating the magnitude, however. The historical comparison is imperfect because we are not controlling for variablessuch as the change in the average size of homes, types of properties (apartment vs. single family) and labor productivity. From the mid-1990s through the bubble, there was a shift toward greater single family homes, which tend to be more labor-intensive than apartments. During the last few years of the bubble, there was an increase in the share of “McMansions” that also required greater labor. As such, the gain in construction jobs outpaced housing starts during this period. We would argue the reverse is true today as households are looking to downsize, either into apartments or smaller single-family properties. The gain in construction jobs may therefore be slower than implied by the historical comparison.

Plugging in our forecast for housing starts through 2014 and lagging five quarters, we think it is reasonable to expect gains of about 225,000 to 250,000 construction jobs this year, which implies nearly 20,000 a month on average (again see Chart 2). We judge this to be a conservative estimate and see upside risk given improvement in renovation spending.