by Calculated Risk on 11/08/2012 11:25:00 AM

Thursday, November 08, 2012

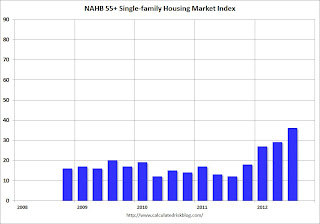

NAHB: Builder Confidence in the 55+ Housing Market Increases in Q3

This is a quarterly index from the the National Association of Home Builders (NAHB) and is similar to the overall housing market index (HMI). The NAHB started this index in Q4 2008, so all readings are very low.

From the NAHB:

Builder Confidence in the 55+ Housing Market Continues to Improve in the Third Quarter

Builder confidence in the 55+ housing market for single-family homes showed significant improvement in the third quarter of 2012 compared to the same period a year ago, according to the National Association of Home Builders' (NAHB) latest 55+ Housing Market Index (HMI) released today. The index more than tripled year over year from a level of 12 to 36, which is the highest third-quarter reading since the inception of the index in 2008.

...

The 55+ multifamily condo HMI had a significant increase of 13 points to 23, which is the highest third-quarter reading since the inception of the index in 2008; however, condos remain the weakest segment of the 55+ housing market. All 55+ multifamily HMI components increased considerably compared to a year ago as present sales rose 13 points to 22, expected sales for the next six months jumped 19 points to 29 and traffic of prospective buyers climbed 11 points to 22.

...

"Like other segments of the housing industry, the market for 55+ housing is continuing on a steady upward path, driven by improving conditions in additional markets around some parts of the country" said NAHB Chief Economist David Crowe "While we expect the upward trend to continue as the recovery broadens, the speed of the recovery is being constrained by factors as tight mortgage credit, making it difficult for potential 55+ customers to sell their current homes, and shortages of inputs to construction such as buildable lots that are beginning to emerge in some market areas."

Click on graph for larger image.

Click on graph for larger image.This graph shows the NAHB 55+ HMI through Q3 2012. All of the readings are very low for this index, but there has been a fairly sharp increase over the last year.

This is going to be a key demographic for household formation over the next couple of decades - if the baby boomers can sell their current homes!

There are two key drivers: 1) there is a large cohort moving into the 55+ group, and 2) the homeownership rate typically increases for people in the 55 to 70 year old age group.

The second graph shows the homeownership rate by age for 1990, 2000, and 2010. This shows that the homeownership rate usually increases until 70 years old or so.

The second graph shows the homeownership rate by age for 1990, 2000, and 2010. This shows that the homeownership rate usually increases until 70 years old or so.So demographics should be favorable for the 55+ market - if these people can sell their current homes.