by Calculated Risk on 11/29/2012 11:00:00 AM

Thursday, November 29, 2012

Kansas City Fed: Regional Manufacturing Activity "Eased Further" in November

From the Kansas City Fed: Tenth District Manufacturing Activity Eased Further

The Federal Reserve Bank of Kansas City released the November Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that Tenth District manufacturing activity eased further in November, while producers’ expectations were unchanged from last month at modestly positive levels.Most of the regional manufacturing surveys were weak in November (Richmond was the exception).

“We saw a decline in regional factory activity for the second straight month, and firms have put hiring plans on hold for the next six months” said Wilkerson. “However, overall production and capital spending are expected to rise moderately in coming months.”

...

Several contacts noted uncertainties about the upcoming fiscal cliff, and a few producers cited delayed deliveries and reduced orders from the East Coast as a result of the Hurricane Sandy. Price indexes moderated slightly.

The month-over-month composite index was -6 in November, down from -4 in October and 2 in September. The composite index is an average of the production, new orders, employment, supplier delivery time, and raw materials inventory indexes. This marked the first time the composite index has been negative for two straight months since mid-2009. Manufacturing slowed at durable goods-producing plants, while nondurable factories reported a slight uptick in activity, particularly for food and plastics products. Other month-over-month indexes were mixed in November. The production index was unchanged at -6, while the new orders and order backlog indexes declined for the third straight month to their lowest levels in three years. In contrast, the employment index increased from -6 to 0, and the shipments and new orders for exports indexes were less negative.

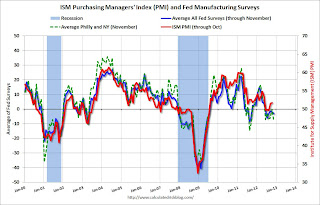

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (dashed green, through November), and five Fed surveys are averaged (blue, through November) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through October (right axis).

The ISM index for November will be released Monday, Dec 3rd, and these surveys suggest another weak reading.