by Calculated Risk on 9/12/2012 07:01:00 AM

Wednesday, September 12, 2012

MBA: Mortgage Applications increase, might be distorted by Holiday adjustment

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

The adjusted Refinance Index increased 12 percent from the previous week. The seasonally adjusted Purchase Index increased 8 percent from one week earlier.

The holiday adjusted numbers may overstate the level of refinance applications because some lenders who rely primarily on the internet/consumer direct channel for originations saw little if any decline in applications for Labor Day as compared with the drops for lenders relying on retail offices, perhaps because borrowers had additional time over the Labor Day weekend to complete online refinance applications.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) decreased to 3.75 percent from 3.78 percent, with points increasing to 0.44 from 0.37 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans. The effective rate decreased from last week.

Click on graph for larger image.

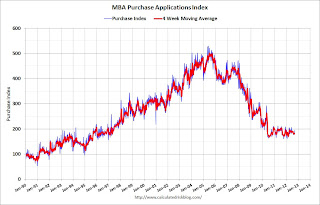

Click on graph for larger image.This graph shows the MBA mortgage purchase index.

The purchase index has been mostly moving sideways over the last two years.