by Calculated Risk on 8/15/2012 12:10:00 PM

Wednesday, August 15, 2012

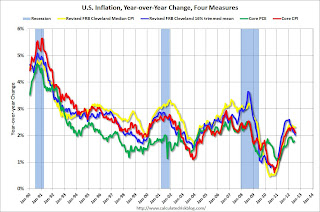

Key Measures show slowing inflation in July

Note: This is the last inflation report before the September FOMC meeting (the August report will be released September 14th and the FOMC meeting is Sept 12th and 13th).

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% (2.5% annualized rate) in July. The 16% trimmed-mean Consumer Price Index increased 0.1% (1.3% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics' (BLS) monthly CPI report.Note: The Cleveland Fed has the median CPI details for July here.

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers was virtually flat at 0.0% (0.6% annualized rate) in July. The CPI less food and energy increased 0.1% (1.1% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.3%, the trimmed-mean CPI rose 2.0%, and core CPI rose 2.1%. Core PCE is for June and increased 1.8% year-over-year.

These measures suggest inflation is now at the Fed's target of 2% on a year-over-year basis and it appears the inflation rate is slowing. On a monthly basis (annualized), two of these measure were well below the Fed's target; trimmed-mean CPI was at 1.3%, Core CPI at 1.1% - although median CPI was at 2.5% and and Core PCE for June was at 2.5%. Based on initial data - and comparing to the increase in August 2011 - it is very likely that the August report will show a further decline in the year-over-year inflation rate.