by Calculated Risk on 8/30/2012 11:00:00 AM

Thursday, August 30, 2012

Kansas City Fed: "Moderate" growth in Regional Manufacturing Activity in August

From the Kansas City Fed: Growth in Tenth District Manufacturing Activity Improved Moderately

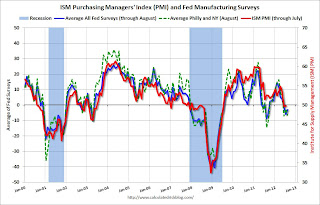

The Federal Reserve Bank of Kansas City released the August Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that growth in Tenth District manufacturing activity improved moderately, and producers’ optimism continued to edge higher.This was below expectations of a 5 reading for the composite index. However the regional manufacturing surveys were mostly weak in August. Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

“Factory activity in our region grew slightly faster this month, in spite of the ongoing drought having a negative effect on producers of agricultural equipment” said Wilkerson. “Firms also expected production to accelerate in coming months.”

...

Growth in Tenth District manufacturing activity improved moderately in August, and producers’ optimism continued to edge higher. Price indexes were relatively stable, although the share of producers planning to raise prices increased further. Several respondents said the ongoing drought has negatively affected their business, mainly through higher input costs and slower sales for agricultural-related products.

The month-over-month composite index was 8 in August, up from 5 in July and 3 in June. The composite index is an average of the production, new orders, employment, supplier delivery time, and raw materials inventory indexes. ... The production index climbed from 2 to 7, and the shipments, new orders, and order backlog indexes all moved back into positive territory. The new orders for export index inched higher but remained below zero, while the employment index dipped slightly from 6 to 2.

Most future factory indexes improved further after rebounding last month. The future composite index edged up from 13 to 16, and future production and shipments indexes increased notably after no change last month. The future order backlog index jumped from 3 to 14, while the employment index remained unchanged.

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (dashed green, through August), and five Fed surveys are averaged (blue, through August) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through July (right axis).

The ISM index for August will be released Tuesday, Sept 4th, and these surveys suggest another weak reading.