by Calculated Risk on 5/01/2012 12:09:00 PM

Tuesday, May 01, 2012

Construction Spending increases slightly in March

Catching up ... This morning the Census Bureau reported that overall construction spending increased slightly in March:

The U.S. Census Bureau of the Department of Commerce announced today that construction spending during March 2012 was estimated at a seasonally adjusted annual rate of $808.1 billion, 0.1 percent (±1.4%) above the revised February estimate of $807.3 billion. The March figure is 6.0 percent (±1.9%) above the March 2011 estimate of $762.6 billion.Private construction spending increased while public spending decreased:

Spending on private construction was at a seasonally adjusted annual rate of $531.9 billion, 0.7 percent (±1.3%) above the revised February estimate of $528.1 billion. Residential construction was at a seasonally adjusted annual rate of $244.1 billion in March, 0.7 percent (±1.3%) above the revised February estimate of $242.5 billion. Nonresidential construction was at a seasonally adjusted annual rate of $287.8 billion in March, 0.7 percent (±1.3%) above the revised February estimate of $285.7 billion.

Click on graph for larger image.

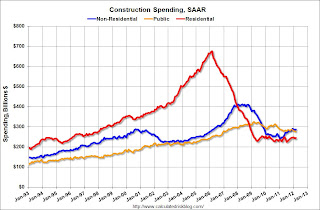

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending is 64% below the peak in early 2006, and up 8.4% from the recent low. Non-residential spending is 30% below the peak in January 2008, and up about 18% from the recent low.

Public construction spending is now 15% below the peak in March 2009 and at a new post-bubble low.

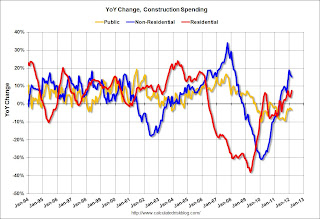

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, both private residential and non-residential construction spending are positive, but public spending is down on a year-over-year basis. The year-over-year improvements in private non-residential are mostly due to energy spending (power and electric).

The year-over-year improvement in private residential investment is an important change (the positive in 2010 was related to the tax credit), and this suggest the bottom is in for residential investment.