by Calculated Risk on 2/05/2012 10:13:00 AM

Sunday, February 05, 2012

Recovery Measures

By request, here is an update to four key indicators used by the NBER for business cycle dating: GDP, Employment, Industrial production and real personal income less transfer payments.

Note: The following graphs are all constructed as a percent of the peak in each indicator. This shows when the indicator has bottomed - and when the indicator has returned to the level of the previous peak. If the indicator is at a new peak, the value is 100%.

These graphs show that several major indicators are still significantly below the pre-recession peaks.

Click on graph for larger image.

Click on graph for larger image.

This graph is for real GDP through Q4 2011. Real GDP returned to the pre-recession in Q3 2011, and Gross Domestic Income (not shown) returned to the pre-recession peak in Q2 - GDI for Q4 will be released with the 2nd estimate of GDP. (For a discussion of GDI, see here).

At the worst point, real GDP was off 5.1% from the 2007 peak. Real GDI was off 5.7% at the trough.

Real GDP has performed better than other indicators ...

Real GDP has performed better than other indicators ...

This graph shows real personal income less transfer payments as a percent of the previous peak through December.

This measure was off 10.7% at the trough.

Real personal income less transfer payments is still 4.8% below the previous peak.

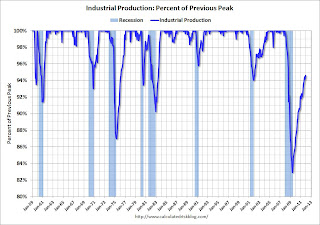

This graph is for industrial production through December.

This graph is for industrial production through December.

Industrial production was off over 17% at the trough, and has been one of the stronger performing sectors during the recovery.

However industrial production is still 5.4% below the pre-recession peak, and it will probably be some time before industrial production returns to pre-recession levels.

The final graph is for employment. This is similar to the graph I post every month comparing percent payroll jobs lost in several recessions.

The final graph is for employment. This is similar to the graph I post every month comparing percent payroll jobs lost in several recessions.

Payroll employment is still 4.1% below the pre-recession peak.

If the economy adds 243 thousand payroll jobs per month on average (the January report), it will take another 2 years to get back to the pre-recession employment peak. And that doesn't count growth of the working age population over the last 4+ years.

Yesterday:

• Summary for Week ending February 3rd

• Schedule for Week of February 5th