by Calculated Risk on 2/17/2012 11:22:00 AM

Friday, February 17, 2012

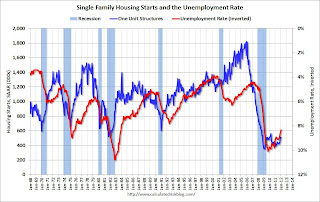

Housing Starts and the Unemployment Rate

An update by request: The following graph shows single family housing starts (through January) and the unemployment rate (inverted) also through January. Note: there are many other factors impacting unemployment, but housing is a key sector.

You can see both the correlation and the lag. The lag is usually about 12 to 18 months, with peak correlation at a lag of 16 months for single unit starts. The 2001 recession was a business investment led recession, and the pattern didn't hold.

Housing starts (blue) increased a little in 2009 with the homebuyer tax credit - and then declined again - but mostly starts moved sideways for two and a half years and only started increasing recently. This was one of the reasons the unemployment rate has remained elevated.

Click on graph for larger image.

Click on graph for larger image.

Usually near the end of a recession, residential investment (RI) picks up as the Fed lowers interest rates. This leads to job creation and also additional household formation - and that leads to even more demand for housing units - and more jobs, and more households - a virtuous cycle that usually helps the economy recover.

However this time, with the huge overhang of existing housing units, this key sector hasn't been participating. The good news is single family starts should increase modestly in 2012, and construction employment should also increase.