by Calculated Risk on 9/22/2011 11:52:00 AM

Thursday, September 22, 2011

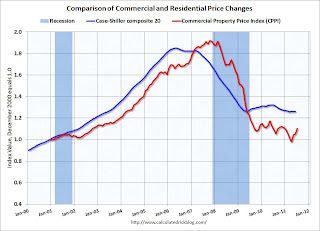

Moody's: Commercial Real Estate Prices increased in July

From Bloomberg: Commercial Real Estate Prices in U.S. Increased 5% in July, Moody’s Says

The Moody’s/REAL Commercial Property Price Index advanced 5 percent from June. It’s up 1.2 percent from a year earlier and almost 13 percent from its post-peak low in April, the New York- based company said in a report today.Below is a comparison of the Moodys/REAL Commercial Property Price Index (CPPI) and the Case-Shiller composite 20 index. Beware of the "Real" in the title - this index is not inflation adjusted.

Demand was driven by middle-market properties that aren’t considered major assets.

...

“This month’s gain is more a continuation of the bottoming process than a harbinger of recovery,” the company said in the report. “Slow job growth will crimp expectations for the absorption of vacant space and for rent increases, which in turn will constrain near term price increases.”

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.CRE prices only go back to December 2000. The Case-Shiller Composite 20 residential index is in blue (with Dec 2000 set to 1.0 to line up the indexes).

According to Moody's, CRE prices are up 1.2% from a year ago and down about 42% from the peak in 2007. Some of this increase was probably seasonal - also this index is very volatile because there are relatively few transactions. Also, this report was for July, and the index will probably be weaker in August after the debt ceiling debate and the renewed fears about Europe.